For the 24 hours to 23:00 GMT, Crude Oil rose 1.59% against the USD and closed at USD58.03 per barrel, as investors were grappled with concerns that supply to the US will remain disrupted as the restart of one of the largest crude pipelines from Canada to the US could take several weeks.

Crude prices extended gains, after the Energy Information Administration (EIA) reported that US crude oil inventories declined by 1.9 million barrels to 457.1 million barrels during the week ended 17 November.

Separately, the Baker Hughes report disclosed that active oil rigs in the US rose by 9 to 747 in the week ended 22 November.

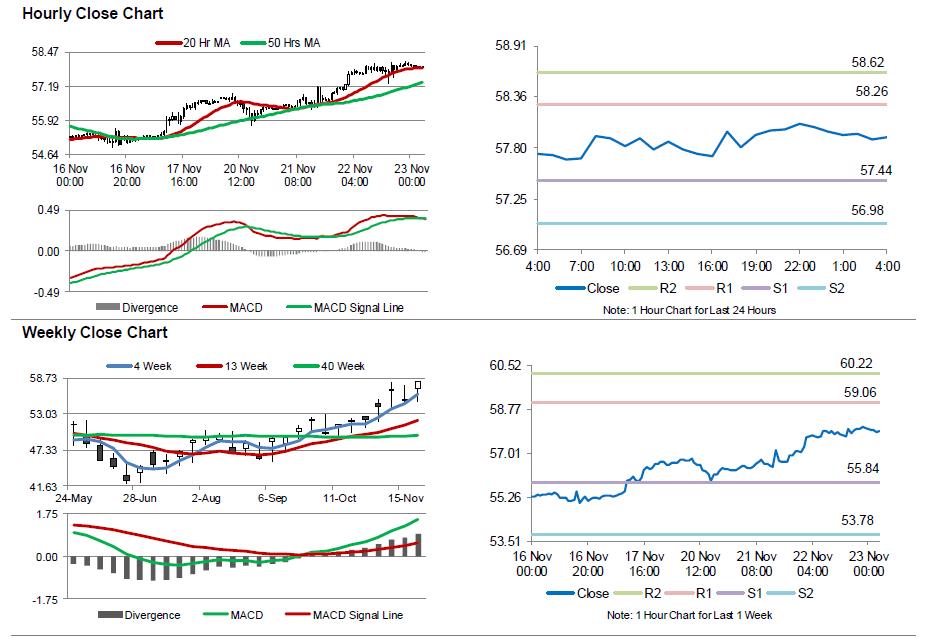

In the Asian session, at GMT0400, the pair is trading at 57.91, with oil trading 0.21% lower against the USD from yesterday’s close.

The pair is expected to find support at 57.44, and a fall through could take it to the next support level of 56.98. The pair is expected to find its first resistance at 58.26, and a rise through could take it to the next resistance level of 58.62.

Crude oil is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.