Crude Oil prices declined 0.15% against the USD for the 24 hour period ending 23:00GMT, closing at 46.20, after weak economic data from China fuelled concerns of slowing demand from the world’s second largest consumer of oil.

Adding to the concerns were reports of record-high production of oil in Russia, thus intensifying fears of a persistent global supply glut.

In the Asian session, at GMT0400, the pair is trading at 46.24, with the oil trading marginally higher from yesterday’s close.

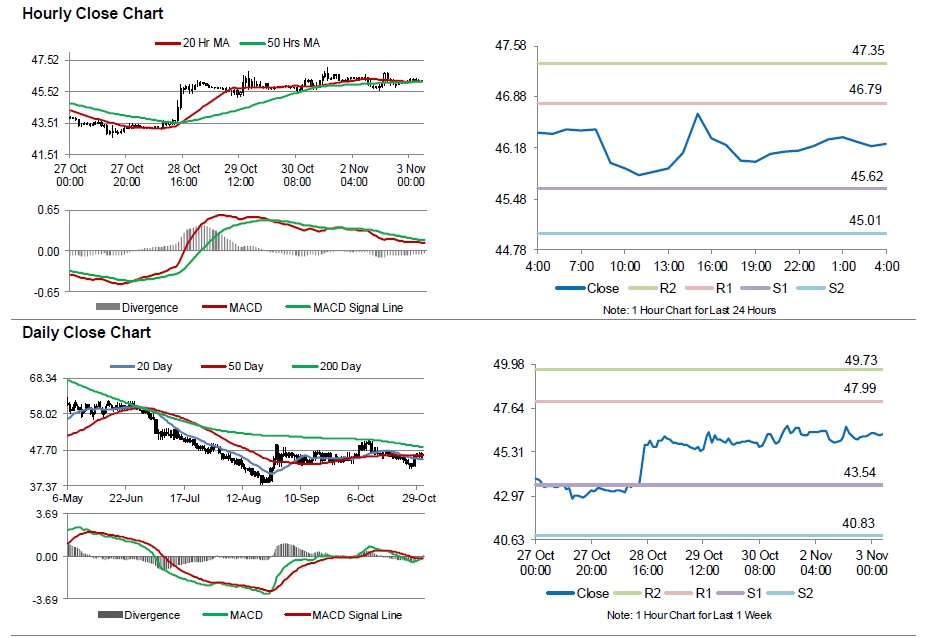

The pair is expected to find support at 45.62, and a fall through could take it to the next support level of 45.01. The pair is expected to find its first resistance at 46.79, and a rise through could take it to the next resistance level of 47.35.

Crude oil is showing convergence with its 20 Hr and 50 Hr moving averages.