Oil prices declined 1.07% against the USD for the 24 hour period ending 24:00GMT, closing at 100.39, after a report on US oil stockpiles suggested weaker fuel demand globally.

According to the Energy Department, US gasoline consumption fell 2.2% to 8 million barrels a day last week, the lowest since the week ended September 21, 2001.

The Energy Information Administration reported a drop of 3.4 million barrels in crude supplies in the week ended January 13. However, gasoline supplies rose 3.7 million barrels, while inventories of distillates climbed 400,000 barrels.

In the Asian session, at GMT0400, Crude Oil is trading at 100.50, 0.11% higher from yesterday’s close.

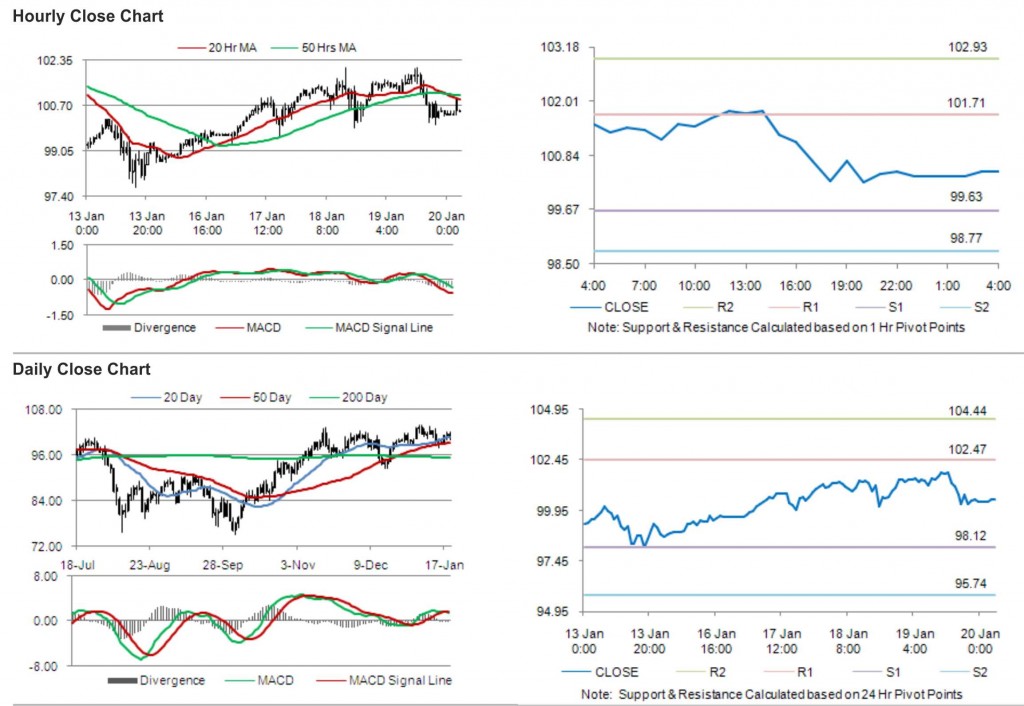

Crude oil is expected to find support at 99.63, and a fall through could take it to the next support level of 98.77. Crude oil is expected to find its first resistance at 101.71, and a rise through could take it to the next resistance level of 102.93.

The pair is trading below its 20 Hr and its 50 Hr moving averages.