Gold prices traded lower by 0.16% against the USD in the 24 hour period ending 23:00GMT, at 1292.90 per ounce, as rally in the world equity markets weighed on the demand prospect of the metal as an alternate investment. Negative sentiment was also fuelled after the Fed’s minutes reinforced policymaker’s optimistic view on the recovery of the world’s largest economy and further indicated that the Federal Reserve would continue tapering its stimulus measures.

Gold prices continued to remain under pressure after data revealed that holdings in the SPDR Gold Trust declined by 3.3 tonnes to 776.89 tonnes on Wednesday, the lowest since December 2008.

However, gold prices received some support after reports from India, the world’s second largest importer of gold, showed that the Reserve Bank of India eased tough rules on gold imports by allowing seven more private agencies to ship the precious metal.

In the Asian session, at GMT0300, Gold is trading at 1291.40, 0.12% lower from yesterday’s close.

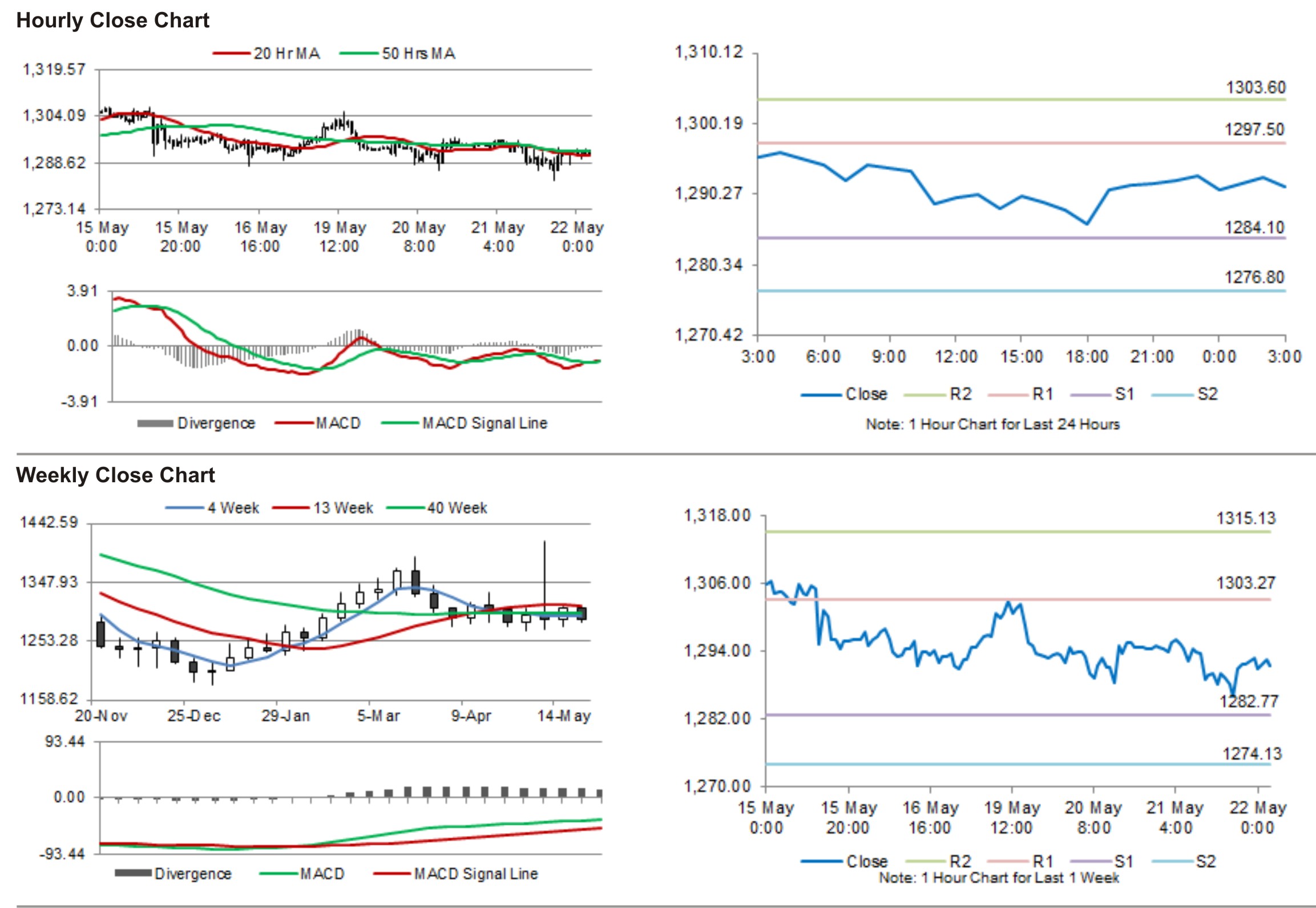

Gold is expected to find support at 1284.10, and a fall through could take it to the next support level of 1276.80. Gold is expected to find its first resistance at 1297.50, and a rise through could take it to the next resistance level of 1303.60.

The yellow metal is showing convergence with its 20 Hr and 50 Hr moving averages.