Gold prices traded higher by 0.19% against the USD in the 24 hour period ending 23:00GMT, at 1293.50 per ounce, amid a broad weakness in the US Dollar and on speculation that the newly formed government in India would possibly ease norms on imports of gold in the nation.

Meanwhile, the European Central Bank and other regional central banks renewed a five-year agreement and pledged not to sell “huge” amounts of bullion in order to avoid unnecessary market turbulence. The previous agreement, which is bound to expire in September, clearly mentions that the countries would not sell more than 400 tonnes of bullion from their combined holdings each year, however, the new agreement does not specify any such limit.

In a separate statement, the World Gold Council reported that, over the past five years, the European central banks sold just 23.5 tonnes of gold out of an estimated reserve of 2,000 tonnes.

In the Asian session, at GMT0300, Gold is trading at 1294.00, marginally higher from yesterday’s close.

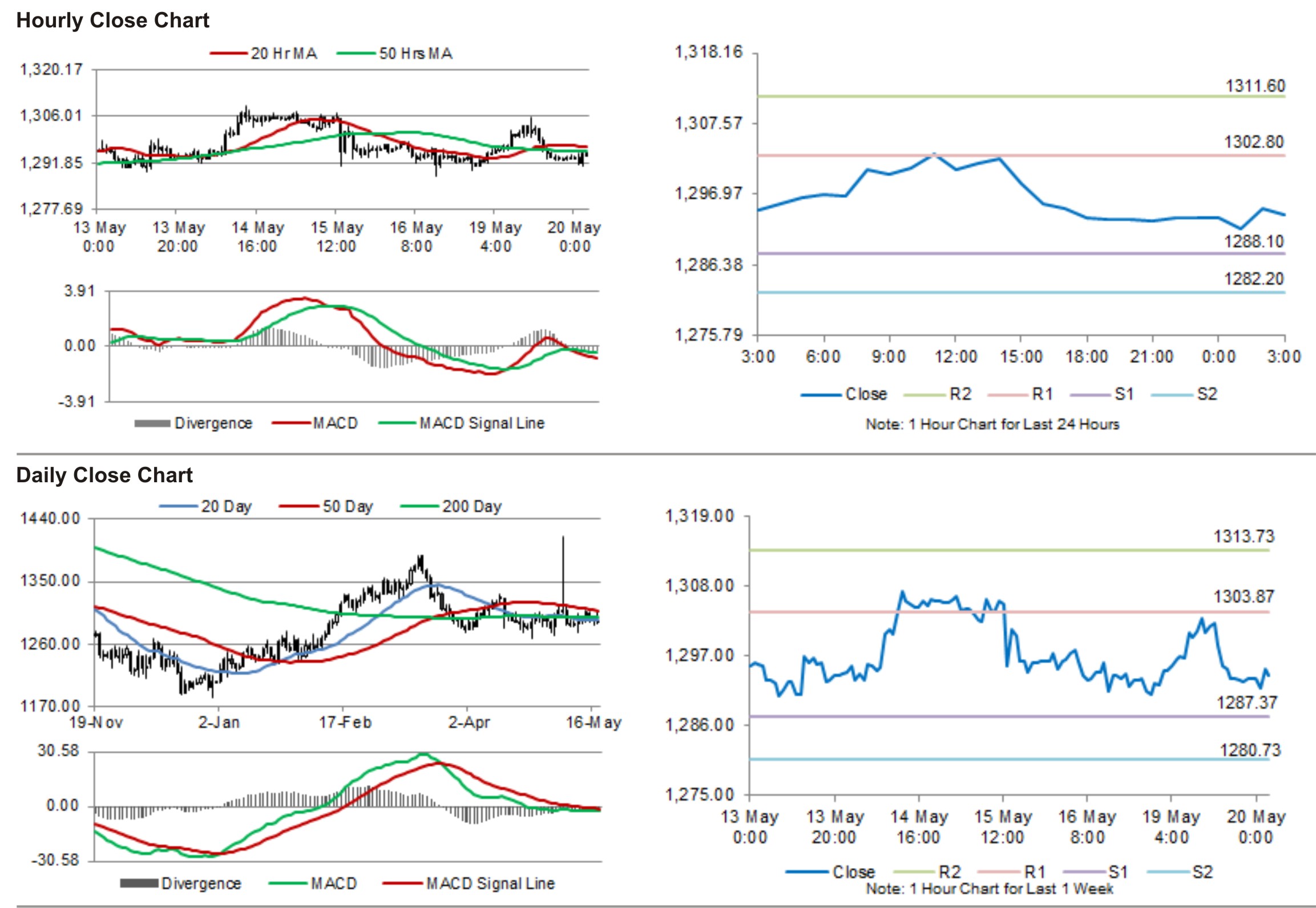

Gold is expected to find support at 1288.10, and a fall through could take it to the next support level of 1282.20. Gold is expected to find its first resistance at 1302.80, and a rise through could take it to the next resistance level of 1311.60.

The yellow metal is trading just below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.