Gold prices traded lower by 0.09% against the USD in the 24 hour period ending 23:00GMT, at 1325.76 per ounce, hurt by a stronger US Dollar and comments from a leading broking house, that forecasted gold prices to resume a decline and end the year at $1,050.0 an ounce, as the US economic growth accelerates. However, strong demand for safe-haven assets on the back of renewed Ukraine concerns, kept the commodity’s losses in check.

In the Asian session, at GMT0300, Gold is trading at 1319.56, 0.47% lower from yesterday’s close.

This morning, the World Gold Council indicated that the gold demand in China, the largest consumer market for gold would rise by around 25% to at least 1,350 metric tons in the next four years, on the back of rise in wealthy population in the nation.

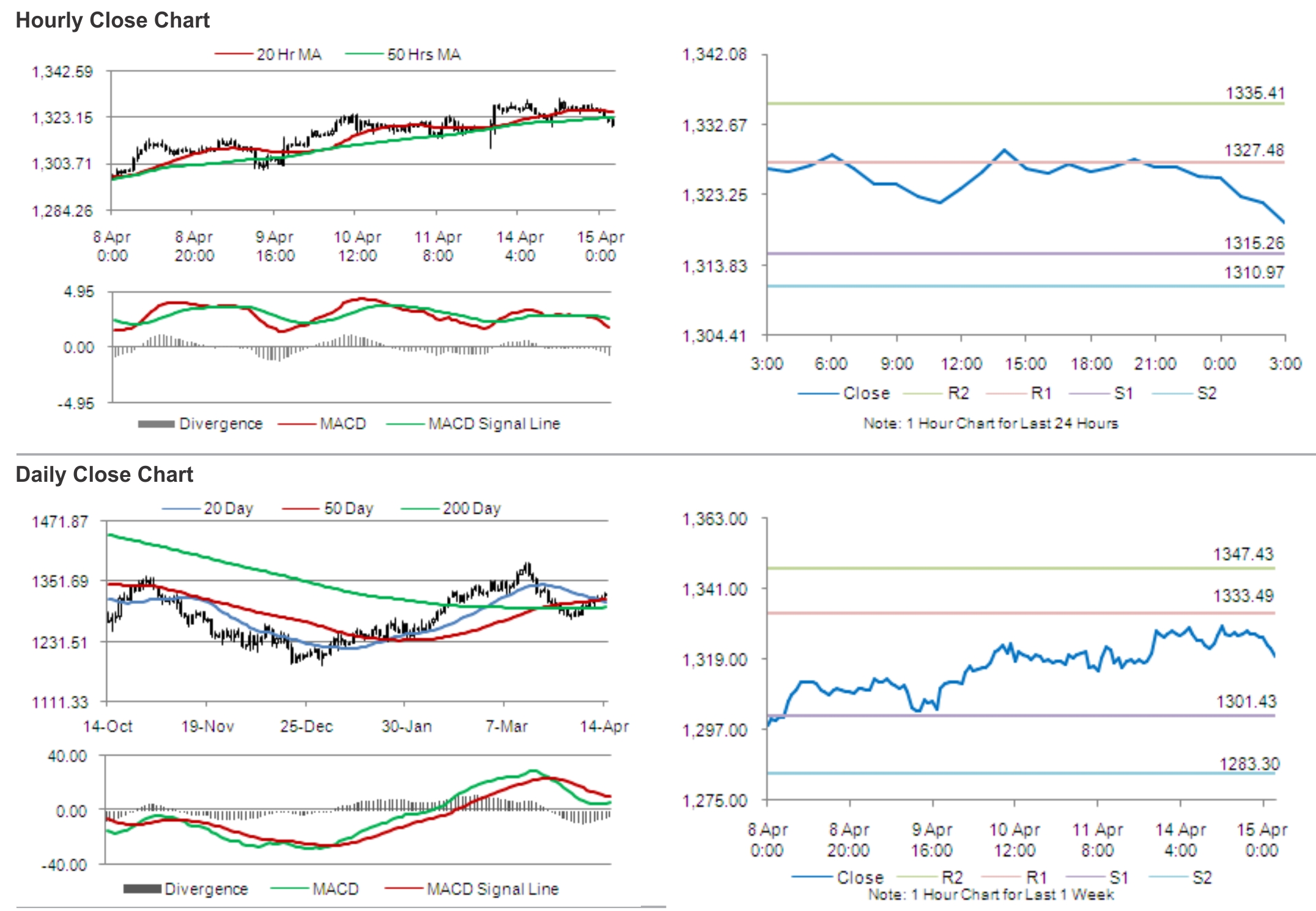

Gold is expected to find support at 1315.26, and a fall through could take it to the next support level of 1310.97. Gold is expected to find its first resistance at 1327.48, and a rise through could take it to the next resistance level of 1335.41.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.