Gold prices traded lower by 0.24% against the USD in the 24 hour period ending 23:00GMT, at 1292.50 per ounce, after the Fed, citing the growth momentum in the US economy, announced its decision to slash its monthly stimulus by yet another $10 billion at the conclusion of its two-day policy meeting in April. Adding to the negative sentiment, SPDR Gold Trust suffered its biggest outflow since 16 April on Wednesday as holding in the world’s largest gold-backed exchange-traded fund fell by 4.19 tonnes to 787.95 tonnes.

In the Asian session, at GMT0300, Gold is trading at 1289.60, 0.22% lower from yesterday’s close.

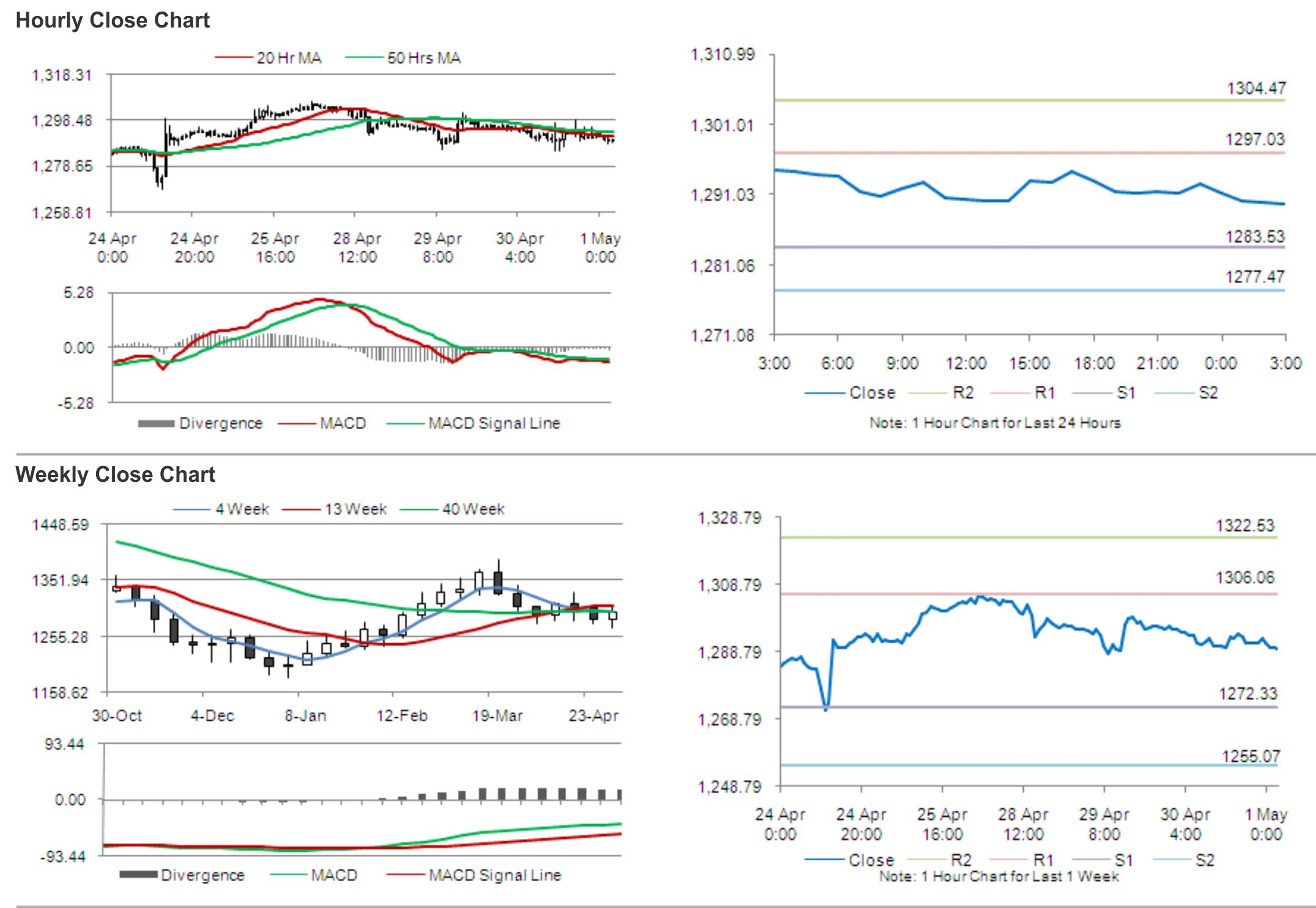

Gold is expected to find support at 1283.53, and a fall through could take it to the next support level of 1277.47. Gold is expected to find its first resistance at 1297.03, and a rise through could take it to the next resistance level of 1304.47.

The yellow metal is trading just below its 20 Hr and 50 Hr moving averages.