Gold prices traded higher by 0.28% against the USD in the 24 hour period ending 23:00GMT, at 1298.80 per ounce, reversing its losses from the previous session which was triggered by Fed Chief, Janet Yellen’s comments that the interest rate in the US would be raised sooner than expected.

Meanwhile, gold prices also found some support from reports that demand from world’s two largest consumers, China and India increased. Official data revealed that the gold imports in India surged 65% to $3.12 billion in June from $1.89 billion a year earlier, following the central bank’s decision to permit more banks and traders to purchase bullion overseas. Additionally, volumes for the benchmark spot contract in China climbed for a second consecutive day to a one-week high of 13,421 kilograms. However, the holdings in the SPDR Gold Trust declined for the first time in a week to 806.03 metric tons. A strong dollar also kept the gains in check.

In the Asian session, at GMT0300, Gold is trading at 1302.40, 0.28% higher from yesterday’s close.

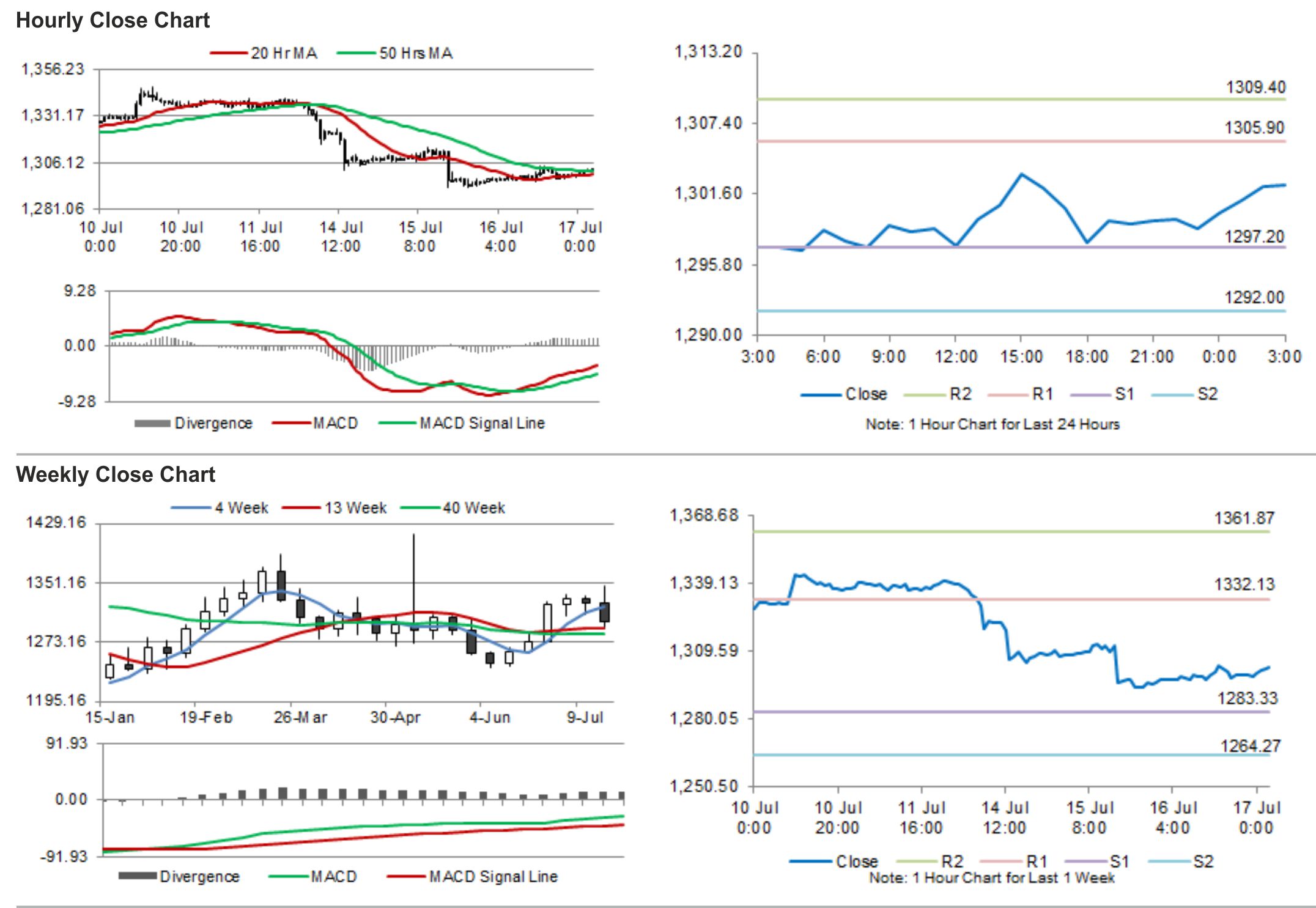

Gold is expected to find support at 1297.20, and a fall through could take it to the next support level of 1292.00. Gold is expected to find its first resistance at 1305.90, and a rise through could take it to the next resistance level of 1309.40.

The yellow metal is showing convergence with its 20 Hr and 50 Hr moving averages.