Gold prices traded lower by 0.25% against the USD in the 24 hour period ending 23:00GMT, at 1304.60 per ounce, after safe haven appeal of the yellow metal diminished following a rally in global equities.

Meanwhile, waning physical demand also weighed on the gold prices. Yesterday, data released by the China Gold Association indicated that demand of gold in China, the largest consumer of gold tumbled 19.4% in the first half of 2014. Elsewhere, another leading broker noted that the demand for the yellow metal would not receive any support from India either as there have been no changes in its gold import restrictions.

In the Asian session, at GMT0300, Gold is trading at 1297.60, 0.54% lower from yesterday’s close.

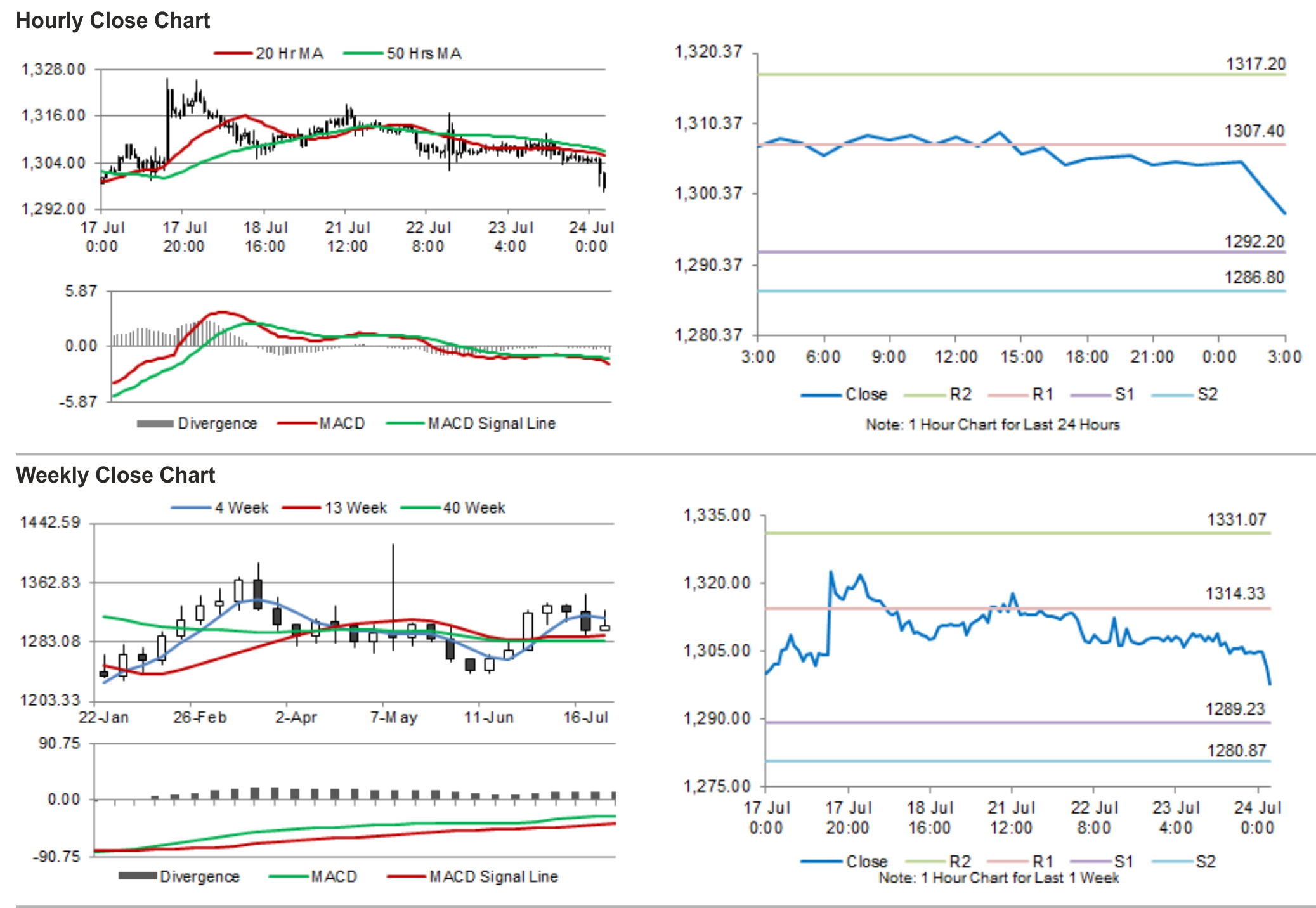

Gold is expected to find support at 1292.20, and a fall through could take it to the next support level of 1286.80. Gold is expected to find its first resistance at 1307.40, and a rise through could take it to the next resistance level of 1317.20.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.