On Friday Gold prices traded higher by 0.27% against the USD in the period ending 21:00GMT, at 1334.70 per ounce, as a weakness in the US Dollar bolstered the demand-outlook of the dollar-denominated commodity. Meanwhile, a leading broking house projected a fall in gold prices from its current levels, due to diminishing concerns on factors such as the weather-impacted US economic activity, Chinese credit concerns and Ukraine crisis.

In the Asian session, at GMT0400, Gold is trading at 1327.74, 0.52% lower from Friday’s close, after data revealed that the manufacturing activity in China unexpectedly fell in March, thereby indicating that the demand for the yellow metal from China, the largest importer of gold may go down.

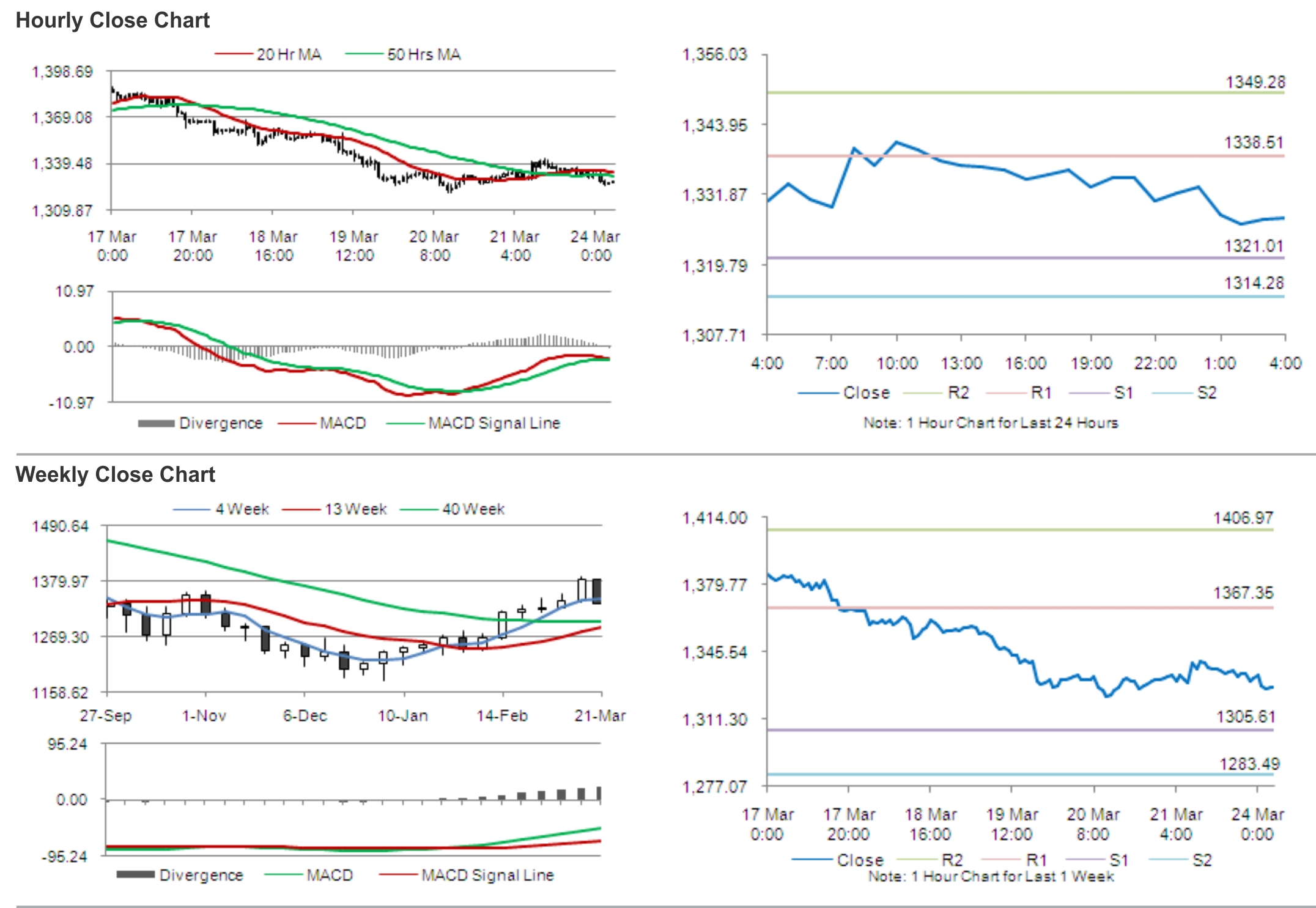

Gold is expected to find support at 1321.01, and a fall through could take it to the next support level of 1314.28. Gold is expected to find its first resistance at 1338.51, and a rise through could take it to the next resistance level of 1349.28.

The yellow metal is trading just below its 20 Hr and 50 Hr moving averages.