Gold prices traded higher by 0.41% against the USD in the 24 hour period ending 23:00GMT, at 1089.10 per ounce, after a decline in global equity markets increased the demand for the precious metal as an alternative investment.

Separately, gold holdings in the SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, edged down to 667.93 tons from its previous level of 670.62 tons.

Going forward, bullion investors would keep a close eye on the US non-farm payroll figures, scheduled later today, as an upbeat jobs data would cement the rising expectations of the Fed tightening its monetary policy at its September FOMC meeting.

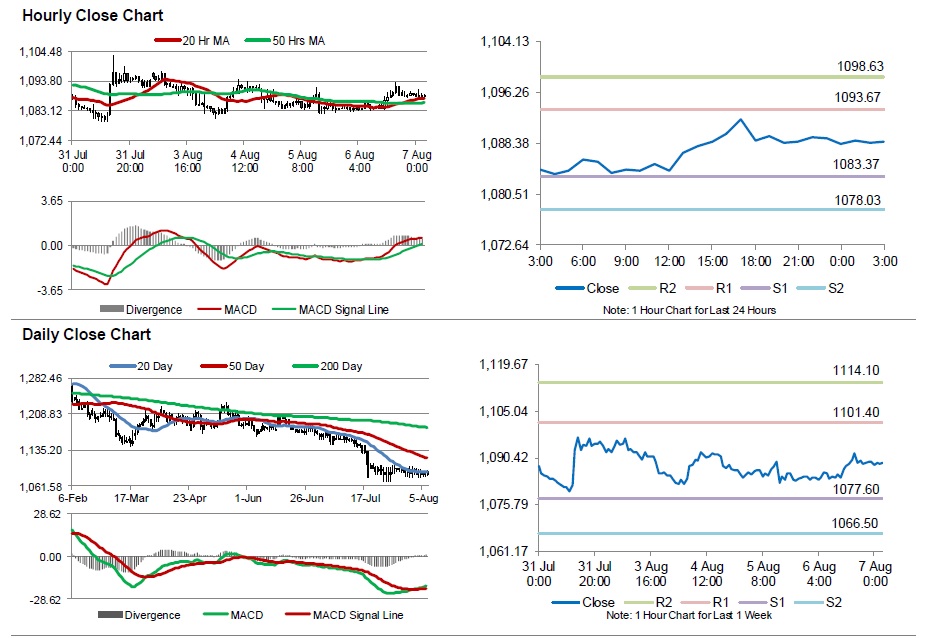

In the Asian session, at GMT0300, the pair is trading at 1088.70, with the gold trading a tad lower from yesterday’s close.

The pair is expected to find support at 1083.36, and a fall through could take it to the next support level of 1078.03. The pair is expected to find its first resistance at 1093.66, and a rise through could take it to the next resistance level of 1098.63.

The yellow metal is trading above its 20 Hr and 50 Hr moving averages.