Gold prices traded higher by 0.51% against the USD in the 24 hour period ending 23:00GMT, at 1193.30 per ounce, as dismal manufacturing activity data from China coupled with an unexpected rise in the US initial jobless claims enhanced demand for the safe-haven precious metal.

Separately, holdings of SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, remained unchanged at 742.35.

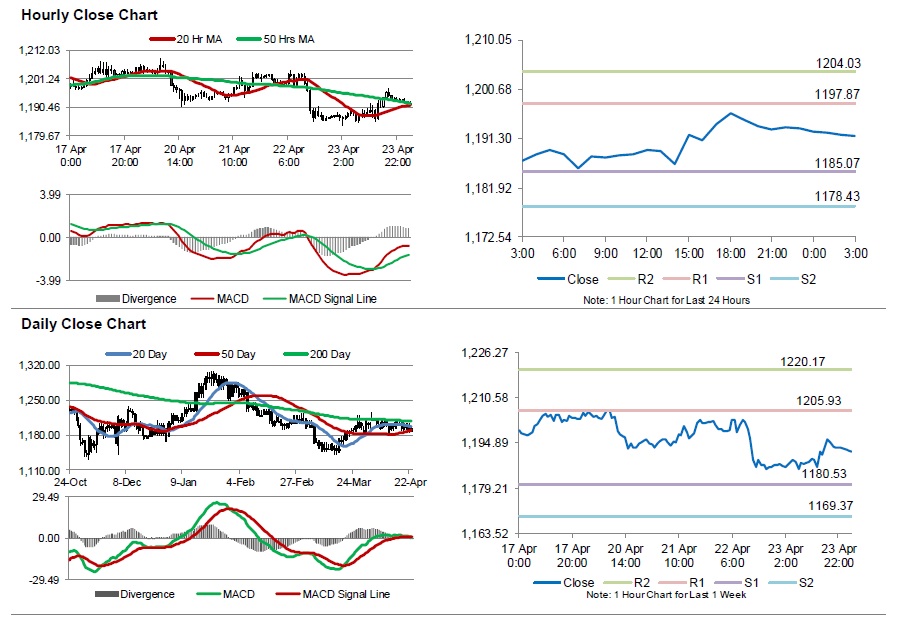

In the Asian session, at GMT0300, the pair is trading at 1191.7, with the gold trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1185.06, and a fall through could take it to the next support level of 1178.43. The pair is expected to find its first resistance at 1197.86, and a rise through could take it to the next resistance level of 1204.03.

The yellow metal is showing convergence with its 20 Hr and 50 Hr moving averages.