Gold prices traded lower by 0.63% against the USD in the 24 hour period ending 23:00GMT, at 1189.30 per ounce, reversing its previous session gains, as investors shrugged off downbeat US inflation data.

Meanwhile, adding to the pressure on the precious metal, the Fed, in its two-day interest rate policy meeting, reported that the central bank was on track to raise its key interest rate sometime next year.

Yesterday, the SPDR Gold Trust revealed that its gold holdings narrowed to 721.56 tons.

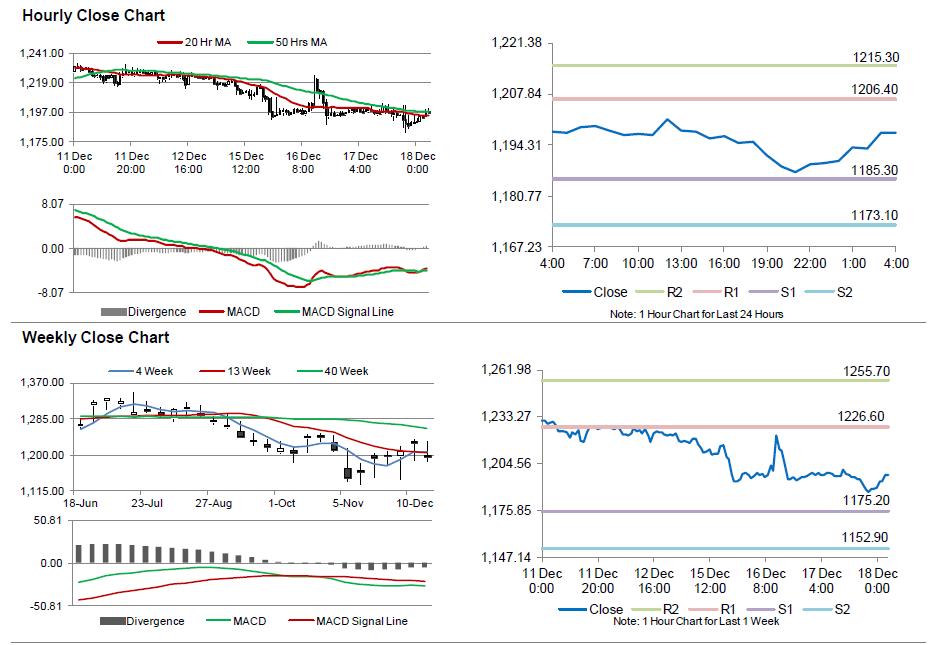

In the Asian session, at GMT0400, the pair is trading at 1197.50, with the gold trading 0.69% higher from yesterday’s close.

The pair is expected to find support at 1185.30, and a fall through could take it to the next support level of 1173.10. The pair is expected to find its first resistance at 1206.40, and a rise through could take it to the next resistance level of 1215.30.

The yellow metal is trading just above its 20 Hr and 50 Hr moving averages.