Gold prices traded lower by 0.95% against the USD in the 24 hour period ending 23:00GMT, at 1146.30 per ounce, after the US Federal Reserve hinted at the possibility of an increase in benchmark interest rates before the end of the year, thus denting the demand for the precious yellow metal.

Separately, the SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, disclosed that its gold holdings dropped 0.17% to 694.34 tonnes.

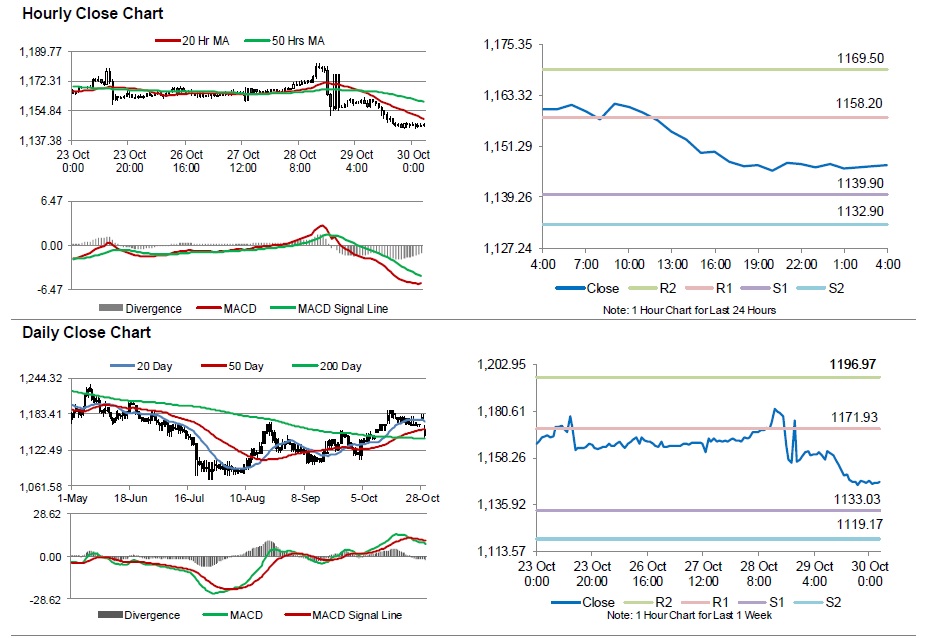

In the Asian session, at GMT0400, the pair is trading at 1146.9, with the gold trading marginally higher from yesterday’s close.

The pair is expected to find support at 1139.90, and a fall through could take it to the next support level of 1132.90. The pair is expected to find its first resistance at 1158.20, and a rise through could take it to the next resistance level of 1169.50.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.