Gold prices traded higher by 1.60% against the USD in the 24 hour period ending 23:00GMT, at 1167.10 per ounce, after the Fed indicated that the central bank may be on path to increase its benchmark rates as early as June, however it was not very optimistic about the economic growth in the world’s largest economy. Moreover, the Fed revised down forecasts of the US economic growth in the coming years.

Meanwhile, holdings in the SPDR Gold Trust retreated to 747.98 tons yesterday, from its previous close of 750.67 tons.

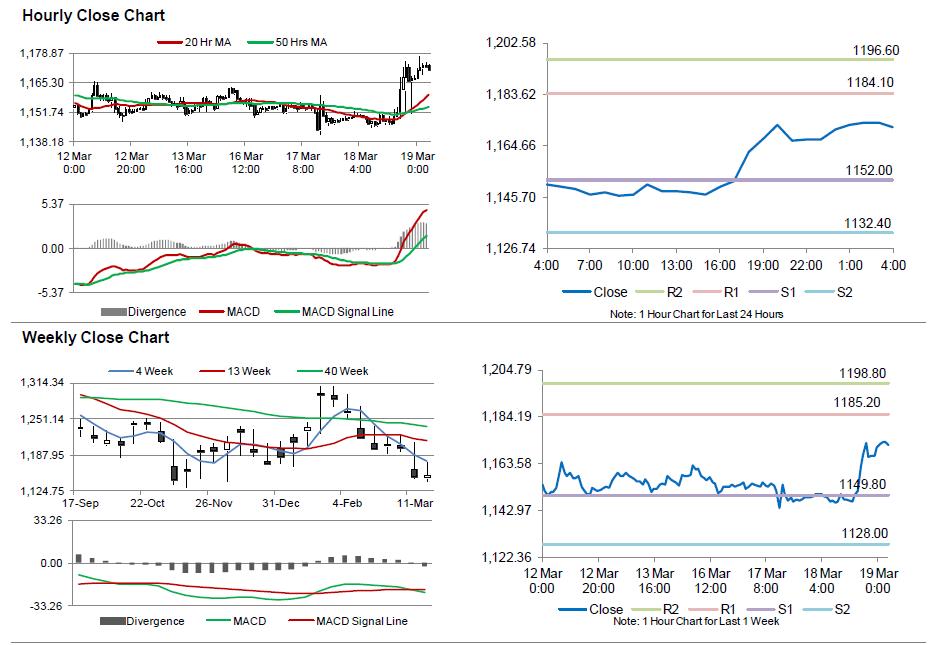

In the Asian session, at GMT0400, the pair is trading at 1171.60, with the gold trading 0.39% higher from yesterday’s close.

The pair is expected to find support at 1152.00, and a fall through could take it to the next support level of 1132.40. The pair is expected to find its first resistance at 1184.10, and a rise through could take it to the next resistance level of 1196.60.

The yellow metal is trading above its 20 Hr and 50 Hr moving averages.