Gold prices traded marginally higher against the USD in the 24 hour period ending 23:00GMT, at 1327.10 per ounce, as geo-political tensions in Ukraine and the Middle East bolstered the safe-haven appeal of the metal. However, a rally in global equity markets capped the gains in the price of the commodity.

Yesterday, media reports showed that Ukraine deployed aircraft and artillery against pro-Russian separatists in the nations while Israel carried out airstrikes in Gaza to avenge death of its three citizens. Separately, data showed that holdings in the SPDR Gold Trust, the world’s largest bullion-backed exchange-traded product, rose 1.4% to 796.39 metric tonnes in the past two-days, reflecting its biggest two-day gain since November 2011.

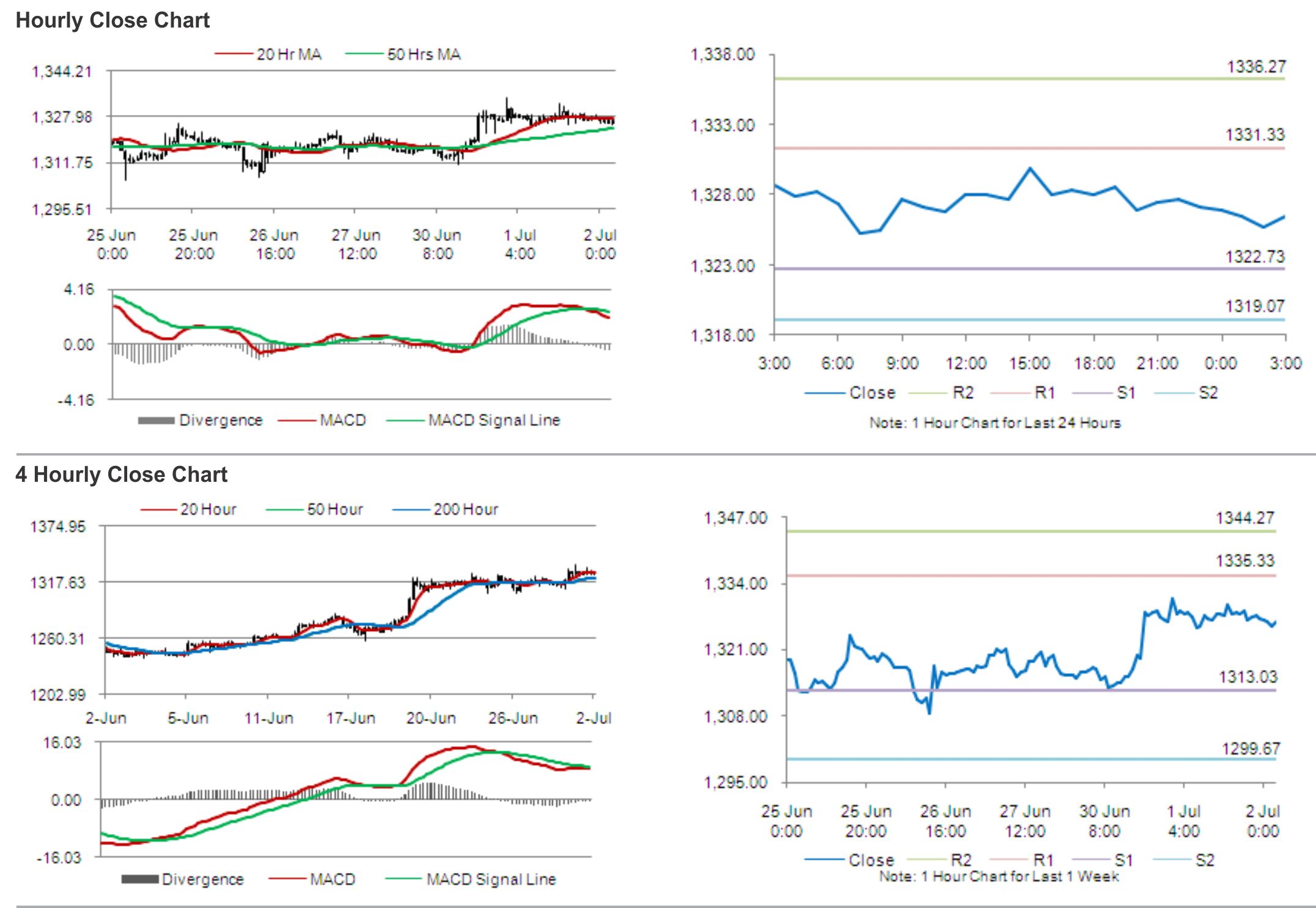

In the Asian session, at GMT0300, Gold is trading at 1326.40, slightly lower from yesterday’s close.

Gold is expected to find support at 1322.73, and a fall through could take it to the next support level of 1319.07. Gold is expected to find its first resistance at 1331.33, and a rise through could take it to the next resistance level of 1336.27.

The yellow metal is trading between its 20 Hr and 50 Hr moving averages.