Gold prices traded lower by 0.35% against the USD in the 24 hour period ending 23:00GMT, at 1167.70 per ounce, on the back of upbeat US ISM manufacturing as well as private sector employment data which hit the demand of the safe-haven yellow metal.

Separately, gold holdings of the SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, remained unchanged at 711.44 tons.

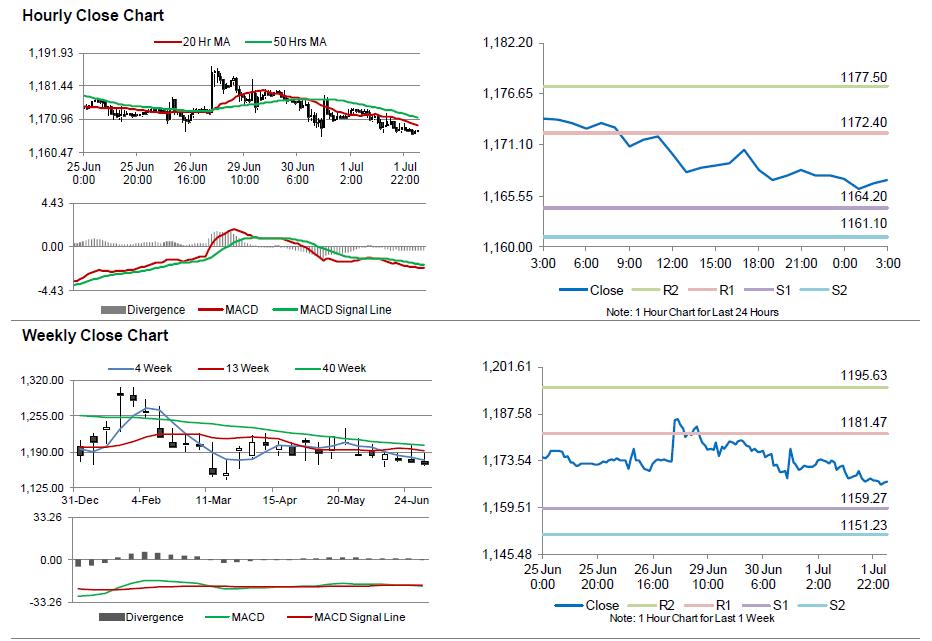

In the Asian session, at GMT0300, the pair is trading at 1167.30, with the gold trading a tad lower from yesterday’s close.

The pair is expected to find support at 1164.20, and a fall through could take it to the next support level of 1161.10. The pair is expected to find its first resistance at 1172.40, and a rise through could take it to the next resistance level of 1177.50.

The yellow metal is trading above its 20 Hr and 50 Hr moving averages.