Gold prices traded higher by 0.09% against the USD in the 24 hour period ending 23:00GMT, at 1319.50 per ounce, as reports suggested a rise in the net-long positions of hedge fund managers for a fourth straight week through 1 July along with a rise in Exchange-Traded Products (ETPs) which has crept up to its highest level since 2012. The US Commodity Futures Trading Commission reported that the net-long position in gold increased 20% to 136,929 futures and options contracts during the week ended 1 July. Additionally, assets in global ETPs climbed 12.6 metric tons last week, the most since November 2012. Meanwhile, gold sales from Perth Mint located in Australia jumped to a four-month high level of 39,405 ounces in June. Yesterday, the SPDR Gold Trust, world’s largest gold-backed exchange-traded fund revealed that its holdings rose 1.8 tonnes to 798.19 tonnes.

Gold prices came under pressure during the day as investors continued to mull over the possibility of an earlier-than-expected hike in the US key interest rates, as last week’s upbeat economic data pointed towards a solid recovery in the world’s largest economy.

In the Asian session, at GMT0300, Gold is trading at 1319.00, marginally lower from yesterday’s close.

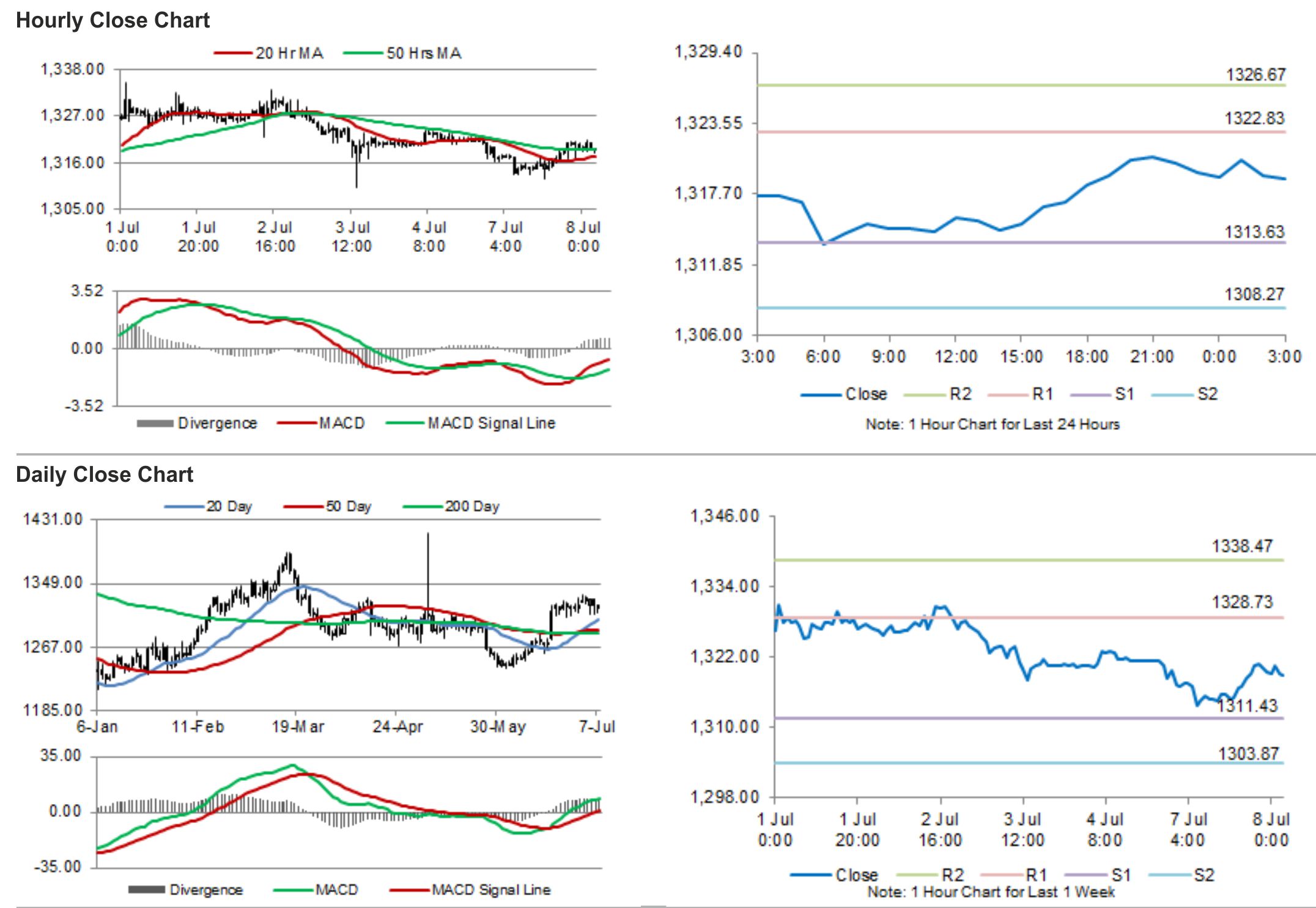

Gold is expected to find support at 1313.63, and a fall through could take it to the next support level of 1308.27. Gold is expected to find its first resistance at 1322.83, and a rise through could take it to the next resistance level of 1326.67.

The yellow metal is showing convergence with its 20 Hr and 50 Hr moving averages.