For the 24 hours to 23:00 GMT, the AUD declined 0.31% against the USD and closed at 0.7118.

Yesterday, the new home sales in Australia dropped 0.40% MoM in July. Meanwhile, the private sector credit in Australia climbed 0.60% MoM in July, higher than market expectations for an advance of 0.50%.

LME Copper prices rose 1.31% or $66.0/MT to $5095.0/MT. Aluminium prices rose 1.44% or $22.0/MT to $1550.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7134, with the AUD trading 0.22% higher from yesterday’s close, after the central bank decided to keep its interest rate steady at 2.00%, meeting market expectations.

Overnight data revealed that Australia’s AIG performance of manufacturing index in August climbed to 51.70.

Earlier this morning, Australia reported a current account deficit of A$19.00 billion in 2Q 2015, on a seasonally adjusted basis, compared to a revised deficit of A$ 13.50 billion in the prior quarter. The seasonally adjusted building approvals in July recorded a rise of 4.20% MoM in Australia, higher than market expectations for a rise of 3.00%.

Elsewhere in China, Australia’s biggest trading partner, Caixin manufacturing and services PMI fell in August from July.

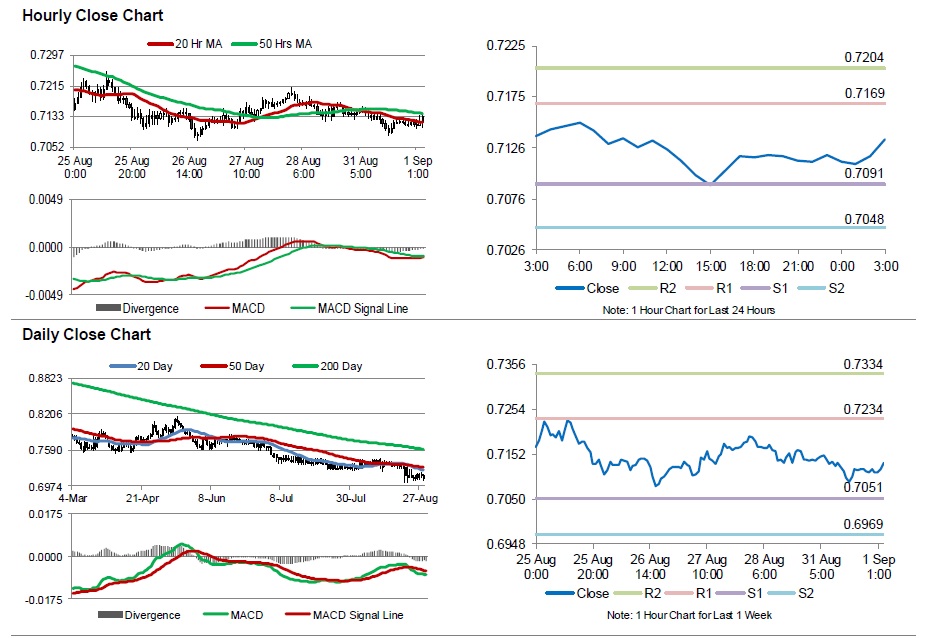

The pair is expected to find support at 0.7091, and a fall through could take it to the next support level of 0.7048. The pair is expected to find its first resistance at 0.7169, and a rise through could take it to the next resistance level of 0.7204.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.