For the 24 hours to 23:00 GMT, AUD strengthened 0.57% against the USD to close at 1.0834, on the back of positive sentiment from Europe’s approval of a second Greek bailout.

In the US, the Federal Reserve Bank of Philadelphia reported that its manufacturing activity index rose to a reading of 3.2 in July, following a reading of -7.7 posted in June. The leading index increased by 0.3% (M-o-M) in June, following a 0.8% rise recorded in May. Additionally, the house price index rose by 0.4% (M-o-M) in May, following a downwardly revised 0.2% increase recorded in April.

In the Asian session at 3:00GMT, the pair is trading at 1.0838, 0.04% higher from yesterday’s close at 23:00 GMT, after a government report showed import and export prices advanced more than expected in the second quarter. In the morning news, the Australian Bureau of Statistics (ABS) reported that the export price index rose by 6.0% in the June quarter, while import prices rose by 0.8%.

LME Copper prices declined 1.6% or $158.8/MT to $9,606.5/ MT. Aluminium prices declined 1.6% or $41.0/MT to $2,473.5/ MT.

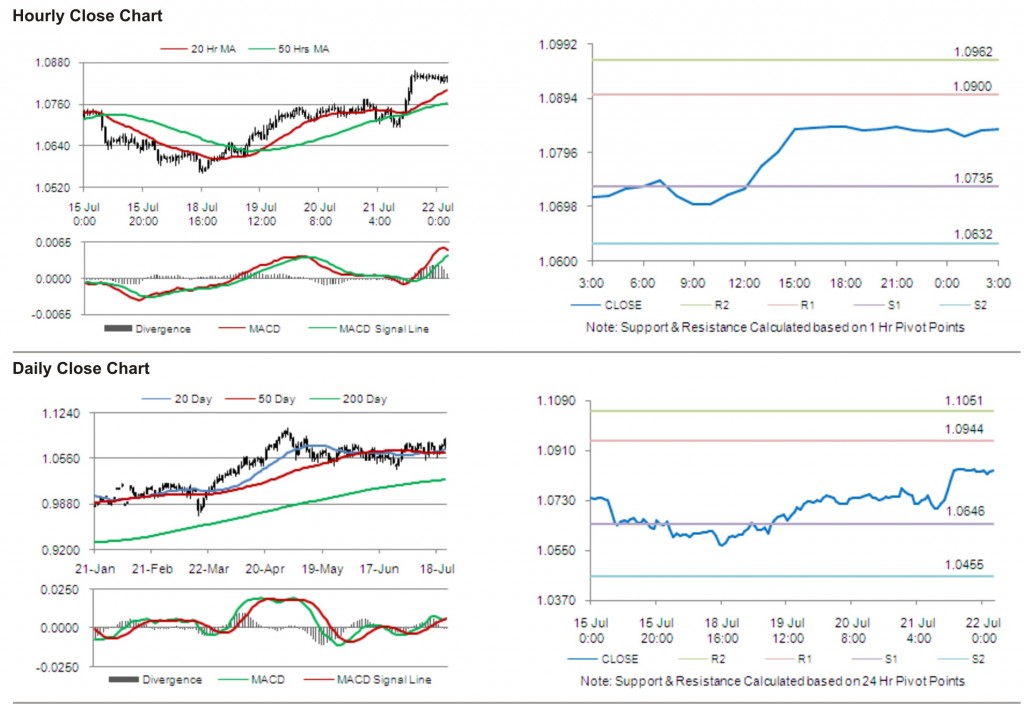

The pair is expected to find first short term resistance at 1.0900, with the next resistance levels at 1.0962 and 1.1127, subsequently. The first support for the pair is seen at 1.0735, followed by next supports at 1.0632 and 1.0467 respectively.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.