On Friday, for the 24 hours to 23:00 GMT, AUD weakened 1.07% against the USD to close at 1.0664, after the Reserve Bank of Australia lowered its growth forecasts to 3.5% from 4.0% for the year ending June 2012, raising speculation of monetary easing.

In the Asian session, at GMT0400, the pair is trading at 1.0738, with the AUD trading 0.7% higher from Friday’s close, on positive home loan data.

The number of new home loans granted in Australia rose more-than-expected to a seasonally adjusted 2.3% in January, from 1.8% in the December. Additionally, investment lending in Australia surged 7.5% in January, following the upwardly revised 2.7% jump in the December.

LME Copper prices rose 0.8% or $70.3/MT to $ 8590.5/ MT. Aluminium prices declined 0.6% or $14.0/MT to $2218.3/ MT.

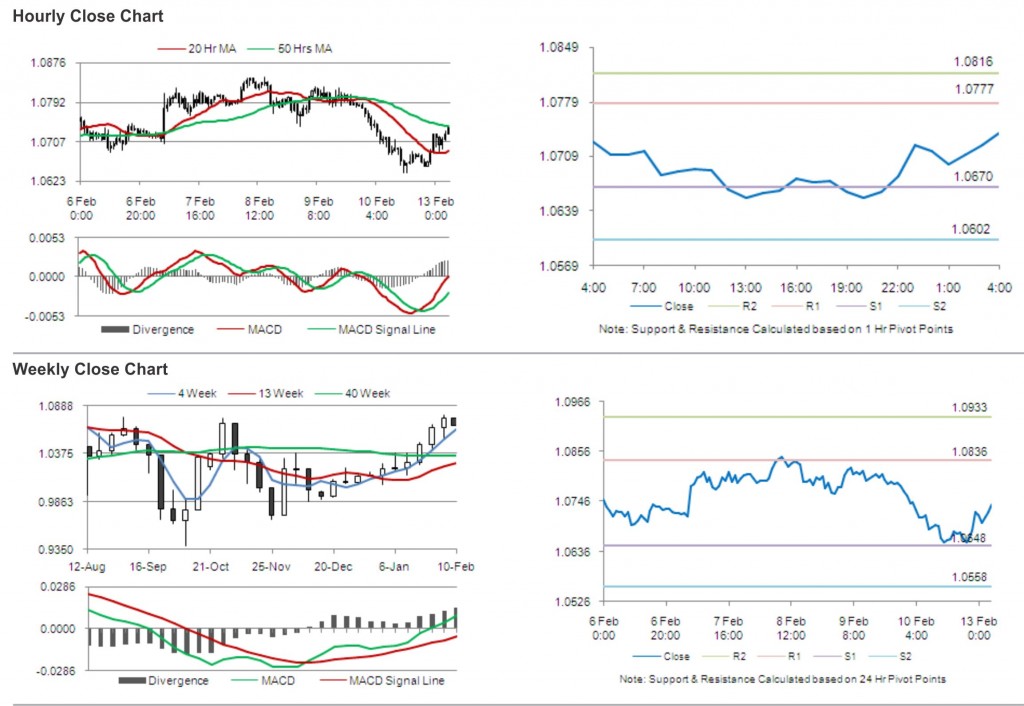

The pair is expected to find support at 1.0670, and a fall through could take it to the next support level of 1.0602. The pair is expected to find its first resistance at 1.0777, and a rise through could take it to the next resistance level of 1.0816.

With no key economic releases in the day ahead, Aussie is expected to ride on general market cues against the greenback.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.