For the 24 hours to 23:00 GMT, the AUD strengthened 0.28% against the USD to close at 0.9333 as the AiG performance of services index in Australia rose to a level of 49.3 in July. The index had recorded a level of 47.6 in the prior month,

LME Copper prices rose 0.4%or $ 26.0/MT to $ 7104.0/MT. Aluminium prices rose/declined 0.7% or $ 14.5/MT to $ 1979.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9324, with the AUD trading tad lower from yesterday’s close.

Earlier this morning, the Reserve Bank of Australia (RBA) has left its key interest rate on hold to a record low level of 2.50% for an entire year. RBA governor Glenn Stevens, in a statement after the RBA’s August rate decision, said that “the most prudent course is likely to be a period of stability in interest rates”. He further added that “continued low interest rates were expected to help growth strengthen over time, although growth was expected to be a little below trend over the year ahead”.

Elsewhere, Australia registered a seasonally adjusted trade deficit of AUD1,683.0 million in June, indicating the third consecutive large deficit. Australia recorded a revised trade deficit of AUD2,043.0 million in the previous month.

Meanwhile, data from China, Australia’s biggest trade partner reported that In July, the services PMI index in China dropped to a 9 year low reading of 50.0, compared to a reading of 53.1 in the previous month.

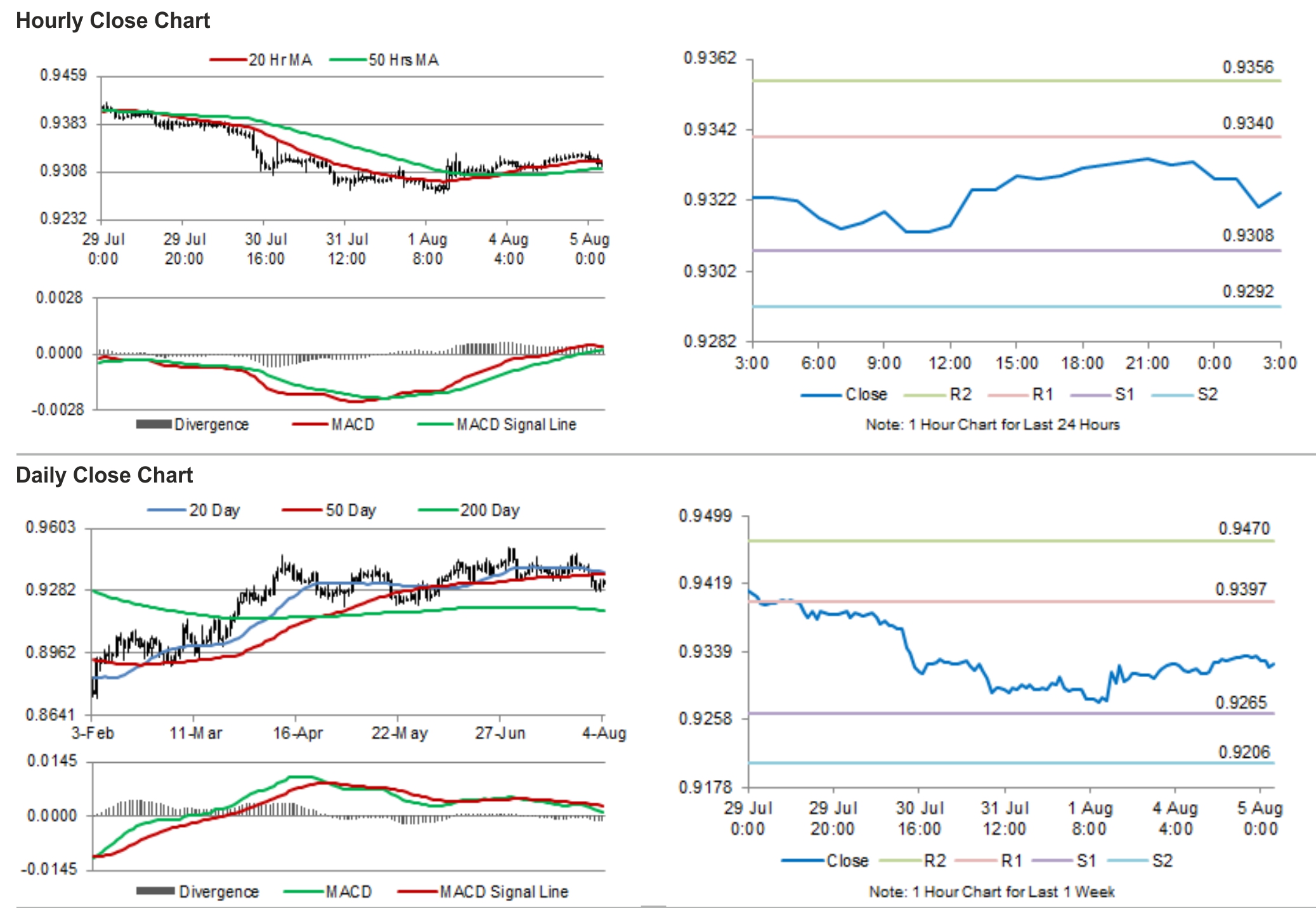

The pair is expected to find support at 0.9308, and a fall through could take it to the next support level of 0.9292. The pair is expected to find its first resistance at 0.934, and a rise through could take it to the next resistance level of 0.9356.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.