For the 24 hours to 23:00 GMT, AUD strengthened 1.20% against the USD to close at 1.0033, after Fitch upgraded Australian foreign currency Issuer Default Rating (IDR) to ‘AAA’ from ‘AA+’ with a ‘Stable’ outlook.

In the Asian session, at GMT0400, the pair is trading at 1.0015, with the AUD trading 0.17% lower from yesterday’s close.

This morning, the private sector credit in Australia rose 0.2% (MoM), compared to 0.5% growth in the previous month. Additionally, capital expenditure rose 12.3% (QoQ) for three months to September, compared to 6.2% rise in the June quarter.

LME Copper prices rose 0.9% or $67.0/MT to $7,448.0/ MT. Aluminium prices declined 0.8% or $15.5/MT to $1,991.0/ MT.

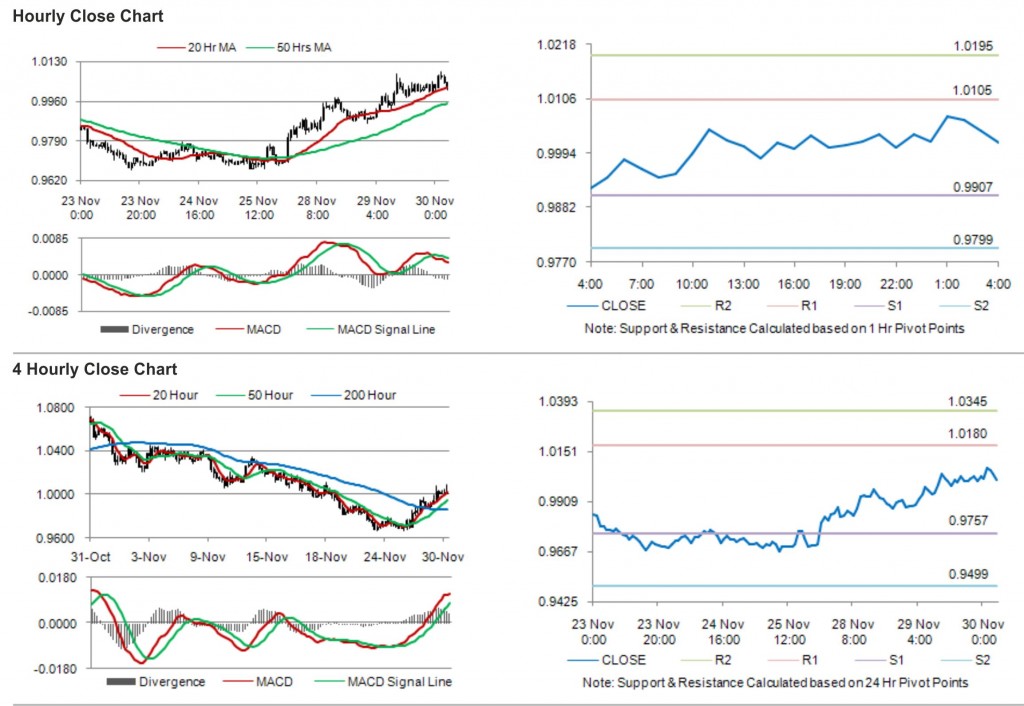

The pair is expected to find support at 0.9907, and a fall through could take it to the next support level of 0.9799. The pair is expected to find its first resistance at 1.0105, and a rise through could take it to the next resistance level of 1.0195.

The pair is expected to trade on the cues from the release of AiG Performance of Manufacturing Index in Australia.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.