For the 24 hours to 23:00 GMT, AUD weakened 0.36% against the USD to close at 1.0376, as investors’ concerns that the Euro-zone debt crisis would spread to Italy, reduced demand for high-yielding assets.

In Australia, this morning, the National Australia Bank’s Business Conditions Index declined to -1.0 in October, compared to 2.0 in the previous month. Additionally, the trade surplus stood at A$2.56 billion in September compared to A$2.95 billion in August.

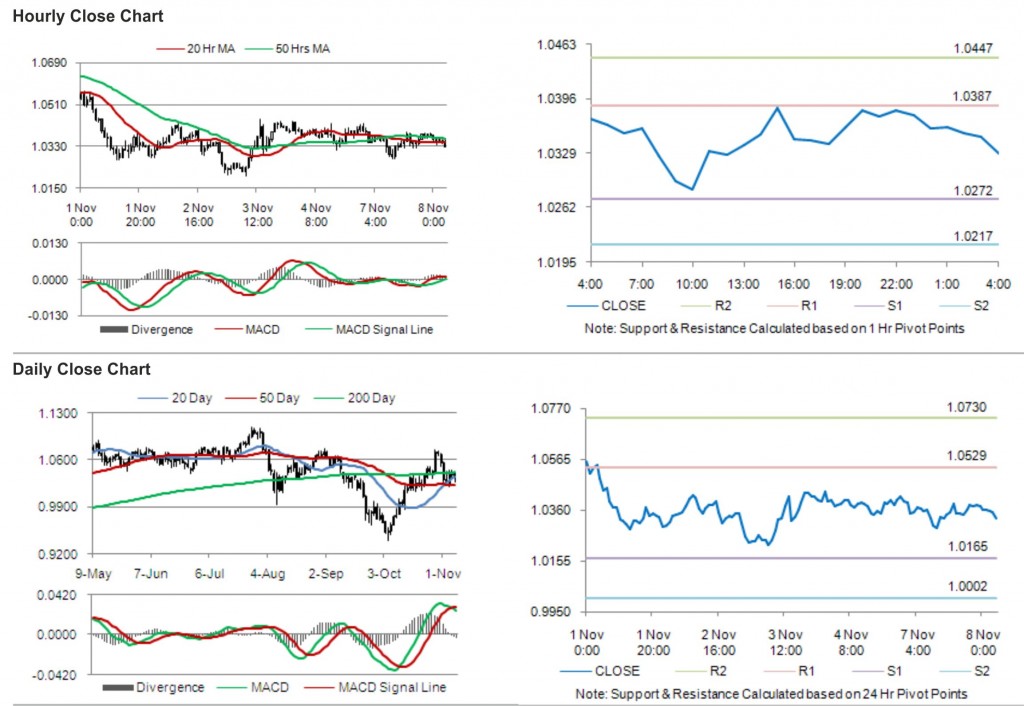

In the Asian session, at GMT0400, the pair is trading at 1.0328, with the AUD trading 0.46% lower from yesterday’s close.

LME Copper prices declined 1.9% or $154.5/MT to $7,775.5/ MT. Aluminium prices declined 0.6% or $12.5/MT to $2,118.0/ MT.

The pair is expected to find support at 1.0272, and a fall through could take it to the next support level of 1.0217. The pair is expected to find its first resistance at 1.0387, and a rise through could take it to the next resistance level of 1.0447.

The pair is expected to trade on the cues from the release of Westpac consumer confidence data in Australia.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.