For the 24 hours to 23:00 GMT, the AUD declined 0.46% against the USD and closed at 0.7650.

LME Copper prices declined 0.6% or $39.5/MT to $6863.0/MT. Aluminium prices slipped 1.0% or $21.0/MT to $2131.0/MT.

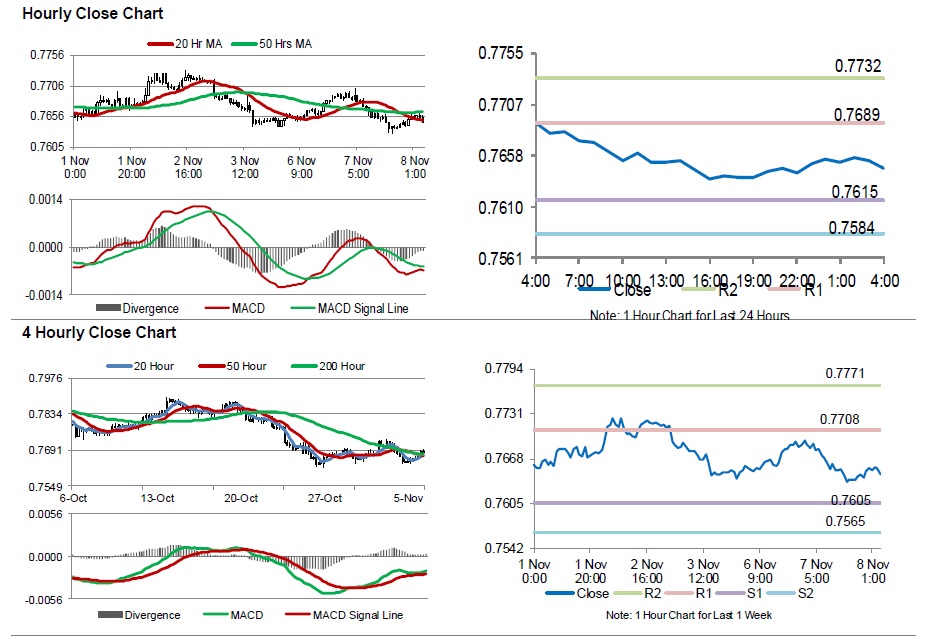

In the Asian session, at GMT0400, the pair is trading at 0.7646, with the AUD trading slightly lower from yesterday’s close.

Earlier today, Australia’s largest trading partner, China reported that its trade surplus widened less than expected to ¥254.5 billion in October from ¥193.0 billion reported in the previous month. Market were expecting trade balance to expand to ¥274.4 billion. Additionally, the nation’s exports rose less than expected by 6.1% YoY last month, while imports jumped by 15.9%.

The pair is expected to find support at 0.7615, and a fall through could take it to the next support level of 0.7584. The pair is expected to find its first resistance at 0.7689, and a rise through could take it to the next resistance level of 0.7732.

Traders will now look forward to Australia’s home loans data for September, due overnight, for further direction.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.