For the 24 hours to 23:00 GMT, the AUD strengthened 0.80% against the USD to close at 0.9019.

LME Copper prices declined 1.0% or $70.5/MT to $7120.0/MT. Aluminium prices edged down 0.1% or $1.0/MT to $1671.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.9048, with the AUD trading 0.32% higher from yesterday’s close. The currency benefitted from a higher-than-expected 10% (YoY) surge in January imports of China, its major trading partner.

However, a report from Australia showed that the Westpac consumer confidence declined 3.0% (MoM) in February, following a 1.7% fall registered in the preceding month.

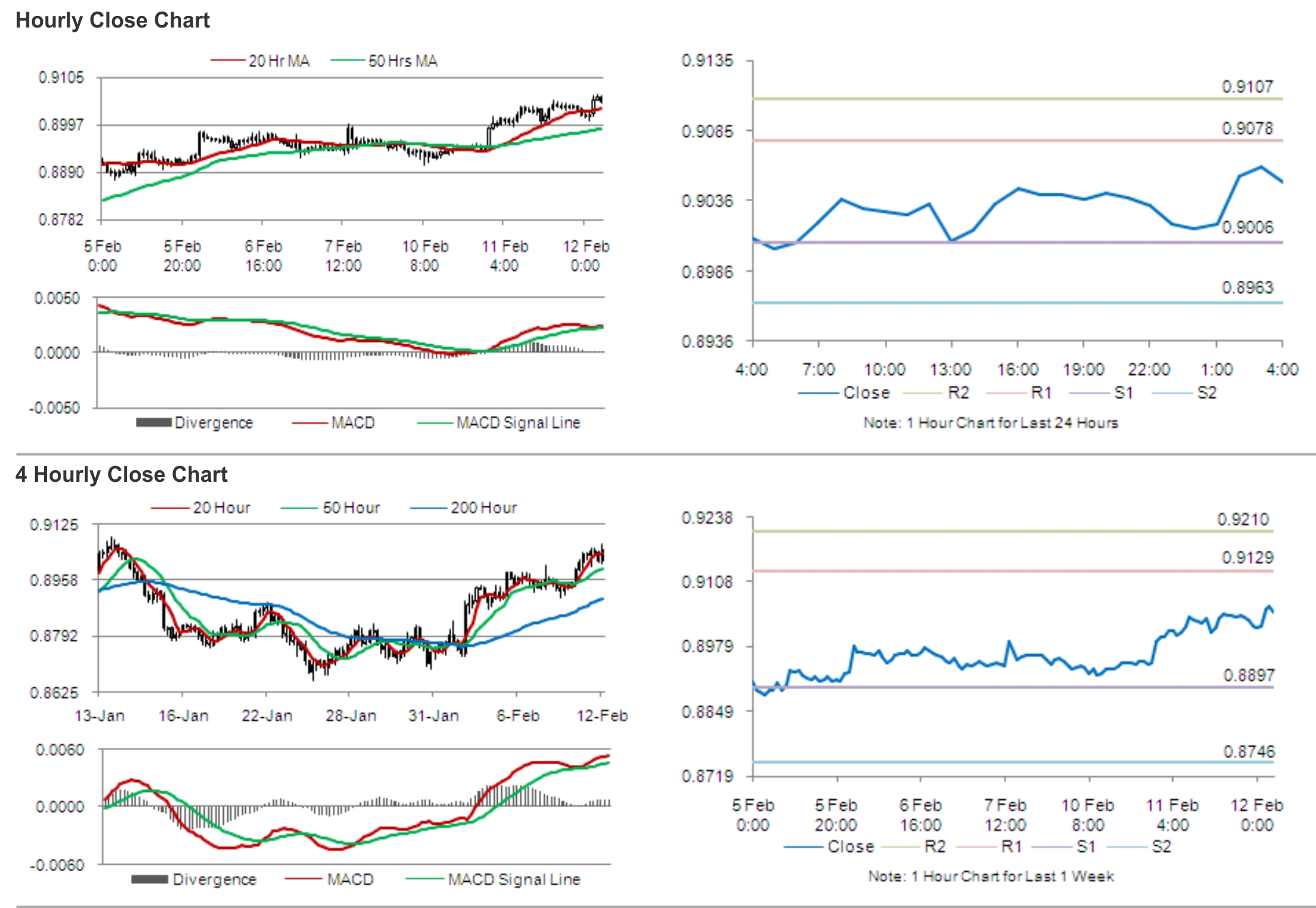

The pair is expected to find support at 0.9006, and a fall through could take it to the next support level of 0.8963. The pair is expected to find its first resistance at 0.9078, and a rise through could take it to the next resistance level of 0.9107.

Going forward, investors would turn their attention to the employment data from Australia along with the consumer inflation expectations’ numbers, to be released tomorrow. Additionally, the Reserve Bank of Australia (RBA) Assistant Governor, Guy Debelle’s speech tomorrow would also be on trader’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.