For the 24 hours to 23:00 GMT, the AUD strengthened 0.39% against the USD to close at 0.8110.

Yesterday, data revealed that Australia’s foreign reserves increased to A$65.7 billion in December, from previous month’s total of $61.7 billion. Also, the nation’s AIG performance of construction index recorded a drop to 44.40 in December. In the prior month, the index had recorded a level of 45.40.

LME Copper prices rose 0.98% or $60.5/MT to $6230.5/MT. Aluminium prices rose 0.82% or $14.5/MT to $1776.5/MT.

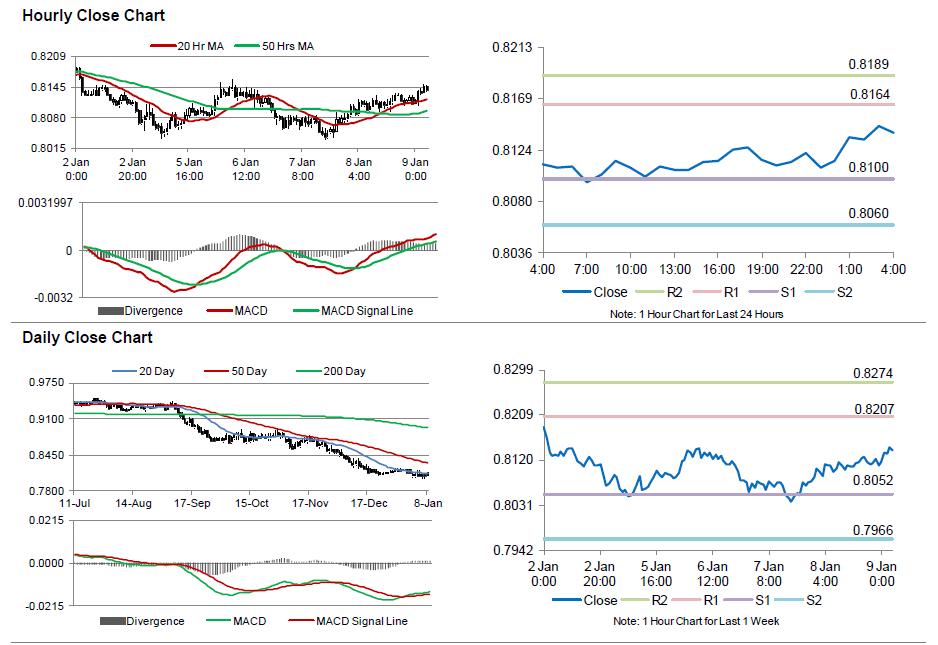

In the Asian session, at GMT0400, the pair is trading at 0.8139, with the AUD trading 0.37% higher from yesterday’s close.

Earlier today, in China, Australia’s biggest trading partner data showed that consumer prices rebounded 0.3% on a MoM basis in December, in line with market expectations and compared to a 0.2% drop recorded in the prior month. On the other hand, the nation’s producer price index eased more than expected 3.3% on an annual basis in December, compared to a decline of 2.7% registered in November.

Data from Australia indicated that retail sales grew 0.1% on a monthly basis in November, missing market forecasts for a 0.2% rise and following an advance of 0.4% recorded in the preceding month.

The pair is expected to find support at 0.8100, and a fall through could take it to the next support level of 0.8060. The pair is expected to find its first resistance at 0.8164, and a rise through could take it to the next resistance level of 0.8189.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.