For the 24 hours to 23:00 GMT, the AUD strengthened marginally against the USD to close at 0.7217.

LME Copper prices rose 0.40% or $21.0/MT to $5295.0/MT. Aluminium prices rose 0.03% or $0.5/MT to $1480.5/MT.

In China, Australia’s largest trading partner, the PBoC cut key interest rates for the sixth time this year in order to revive the ailing Chinese economy. The central bank lowered the one-year benchmark lending rate by 25 basis points to 4.35% and the one-year benchmark deposit rate to 1.5%, from 1.75%.

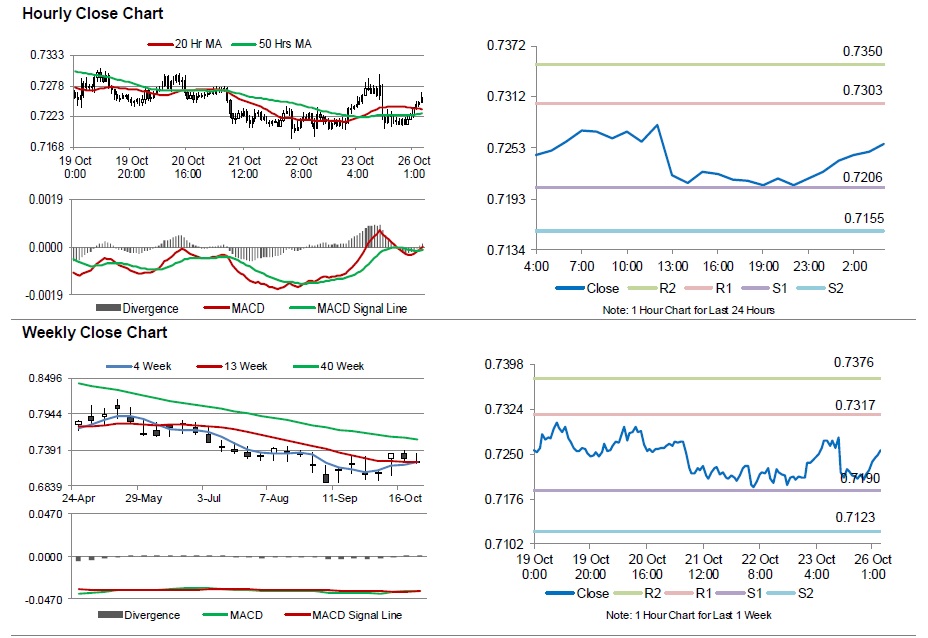

In the Asian session, at GMT0400, the pair is trading at 0.7257, with the AUD trading 0.56% higher from Friday’s close.

The pair is expected to find support at 0.7206, and a fall through could take it to the next support level of 0.7155. The pair is expected to find its first resistance at 0.7303, and a rise through could take it to the next resistance level of 0.7350.

With no economic releases in Australia today, investors will look forward to Australia’s Q3 consumer price inflation data, scheduled to be released this week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.