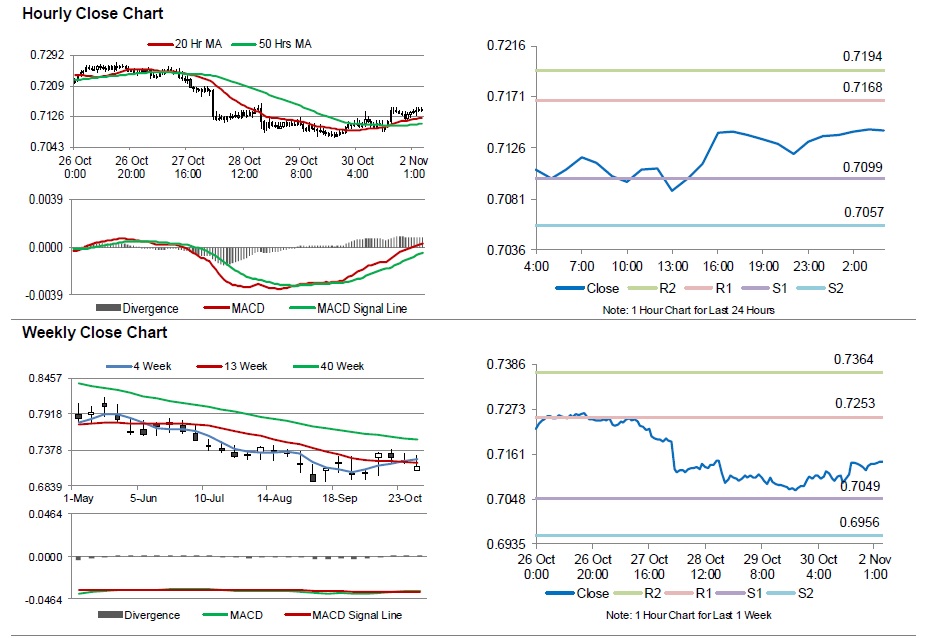

For the 24 hours to 23:00 GMT, the AUD strengthened 0.69% against the USD to close at 0.7129.

LME Copper prices declined 0.49% or $25.5/MT to $5135.5/MT. Aluminium prices rose 0.49% or $7.0/MT to $1447.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7141, with the AUD trading 0.17% higher from Friday’s close.

Over the weekend, Australia’s AiG performance of manufacturing index fell to a level of 50.2 in October, from a reading of 51.7 in the previous month.

Elsewhere, in China, Australia’s biggest trading partner, the NBS manufacturing PMI unexpectedly remained unchanged at a level of 49.8 in October, remaining in the contraction territory for the third consecutive month and compared to market expectations of a rise to 50.0.

Early morning data showed that Australia’s building approvals rebounded 2.2% MoM in September, following a drop of 9.5% in August and against market expectations for a rise of 1.0%.

Separately, in China, the flash Caixin manufacturing PMI rose more-than-expected to a level of 48.3 in October, compared to a reading of 47.2 in the previous month. Markets were anticipating it to rise to a level of 47.6.

The pair is expected to find support at 0.7099, and a fall through could take it to the next support level of 0.7057. The pair is expected to find its first resistance at 0.7168, and a rise through could take it to the next resistance level of 0.7194.

Moving ahead, market participants will keep a close eye on RBA’s interest rate decision, scheduled to be announced early morning tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.