For the 24 hours to 23:00 GMT, the AUD rose 0.59% against the USD and closed at 0.7232.

LME Copper prices rose 1.52% or $69.5/MT to $4655.0/MT. Aluminium prices rose 3.09% or $48.0/MT to $1600.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7241, with the AUD trading 0.12% higher from yesterday’s close.

Early this morning, in China, Australia’s largest trading partner, house price index rose by 2.5% YoY in January, following a gain of 1.6% in the previous month.

Separately, the PBOC Governor, Zhou Xiaochuan, stated that China’s economic fundamentals remain sound and also hinted that further interest rate cuts are on the table. Further, he added that the central bank’s monetary policy still has more room and tools to tackle downward pressure in the economy but ruled out any possibility of further devaluation of the Yuan.

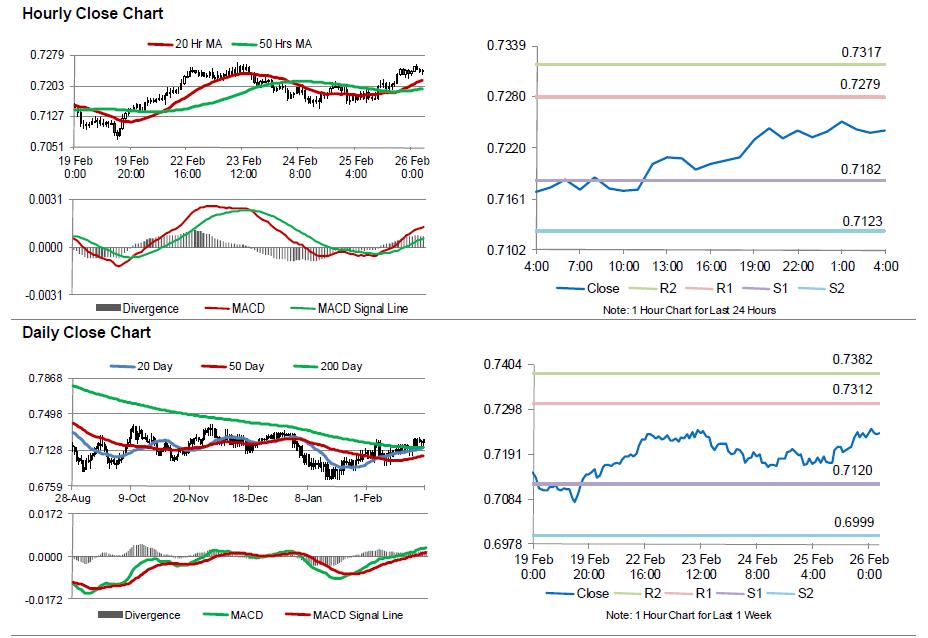

The pair is expected to find support at 0.7182, and a fall through could take it to the next support level of 0.7123. The pair is expected to find its first resistance at 0.7279, and a rise through could take it to the next resistance level of 0.7317.

Going ahead, market participants will closely monitor the RBA interest rate decision along with the release of Australia’s Q4 GDP, trade balance and retail sales data, all scheduled to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.