For the 24 hours to 23:00 GMT, the AUD strengthened 0.99% against the USD to close at 0.7264, after the RBA Governor expressed optimism over Australia’s economic outlook.

Yesterday, RBA Governor, Glenn Stevens, sounded upbeat about the Australian economy over the next couple of years, backed by prospective improvements in the nation’s non-mining sector. Further, he agreed with the argument for holding the cash rate target steady at 2.0% at the board’s next December meeting.

Separately, Australia’s Federal Treasury lowered its forecasts for the nation’s long-term economic growth due to a decrease in the working-age population and a decline in working hours. The economy’s potential GDP is expected to grow by about 2.75% annually over the next few years, down from 3.0%, earlier estimated in the federal budget. Moreover, the rate is projected to fall further, reaching 2.5% by 2050, as the population ages.

LME Copper prices rose 0.25% or $11.5/MT to $4527.0/MT. Aluminium prices rose 0.63% or $9.0/MT to $1433.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7275, with the AUD trading 0.15% higher from yesterday’s close.

Early morning data showed that in China, Australia’s largest trading partner, the Westpac-MNI consumer sentiment index rose to a level of 113.1 in November, from a record-low reading of 109.7 in the previous month.

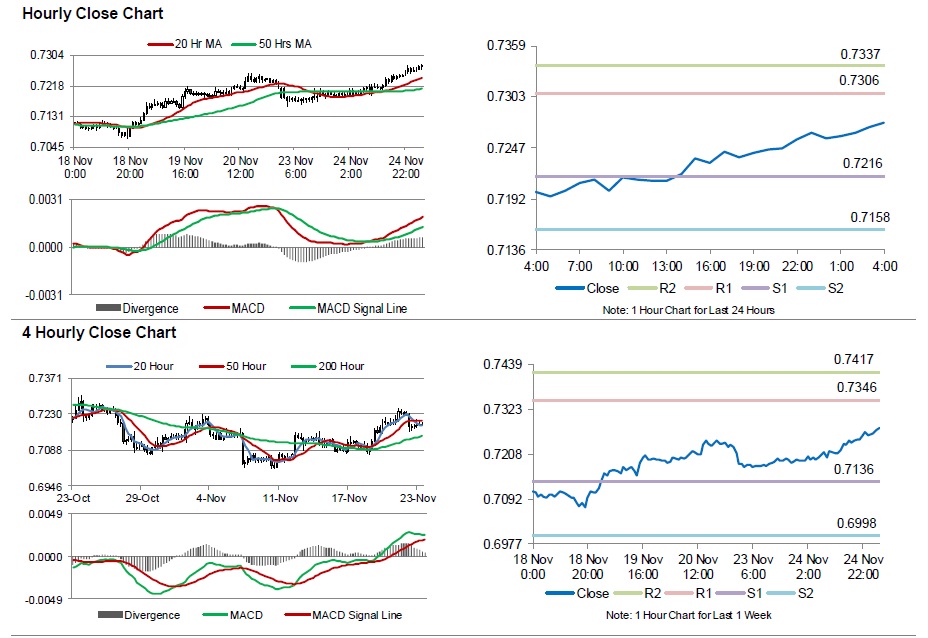

The pair is expected to find support at 0.7216, and a fall through could take it to the next support level of 0.7158. The pair is expected to find its first resistance at 0.7306, and a rise through could take it to the next resistance level of 0.7337.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.