On Friday, the AUD weakened 0.47% against the USD to close at 0.8042.

LME Copper prices declined 0.67% or $-43.0/MT to $6356.0/MT. Aluminium prices declined 1.79% or $33.0/MT to $1813.0/MT.

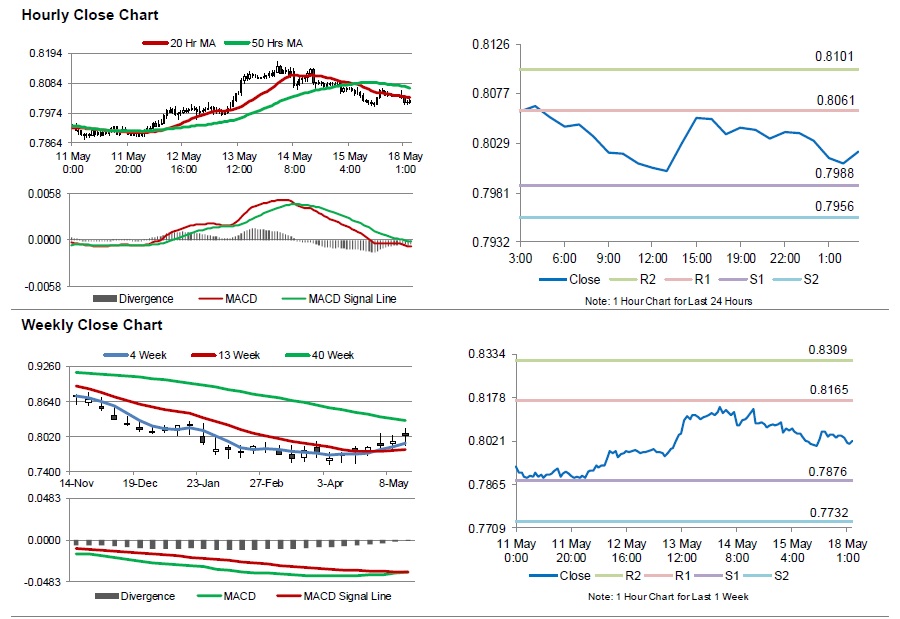

In the Asian session, at GMT0300, the pair is trading at 0.8021, with the AUD trading 0.27% lower from Friday’s close.

Earlier today, Australia’s new motor vehicle sales slid 1.5% MoM in April, from prior month’s increase of 0.7%.

Separately, the RBA Deputy Governor, Philip Lowe opined that the record low interest rates in Australia have aided in boosting spending and wean away the nation from its dependence on mining investment. However, he warned borrowers against taking too much debt, highlighting the increasing concerns about a potential housing bubble.

Elsewhere, in China, Australia’s biggest trading partner, the house price index dropped 6.1% in April, compared to a similar fall registered in the prior month.

The pair is expected to find support at 0.7988, and a fall through could take it to the next support level of 0.7956. The pair is expected to find its first resistance at 0.8061, and a rise through could take it to the next resistance level of 0.8101.

Meanwhile, investors await the release of the RBA minutes, scheduled in the early hours tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.