On Friday, the AUD weakened 0.19% against the USD to close at 0.9398.

Australian Treasurer, Joe Hockey reassured New Zealand, Australia’s second biggest trading partner, that the Australian economy is in good condition and the nation is not in trouble nor is any sort of crisis brewing in the economy. Further, he added that the government’s reforms were about continuing growth and stimulating other parts of the economy as well.

LME Copper prices rose 0.5% or $32.5/MT to $ 7183.5/MT. Aluminium prices declined 0.2% or $5.0/MT to $ 2008.5 /MT.

In the Asian session, at GMT0300, the pair is trading at 0.9395, with the AUD trading slightly lower from Friday’s close, after Chinese Premier, Li Keqiang, revealed that downward pressure continues to remain on the Chinese economy, despite it performing well in the first half of 2014. Additionally, a local think tank, earlier this morning, indicated that Australia’s largest trading partner, China would find it difficult to sustain a 7.5% growth level reached in the second quarter for the rest of the year, citing deteriorating consumer spending and the downbeat real estate market.

Data released over the weekend from China indicated that industrial profits in the nation climbed 11.4% in China on a year to date basis, in June, compared to 9.8% rise recorded in the January to May period.

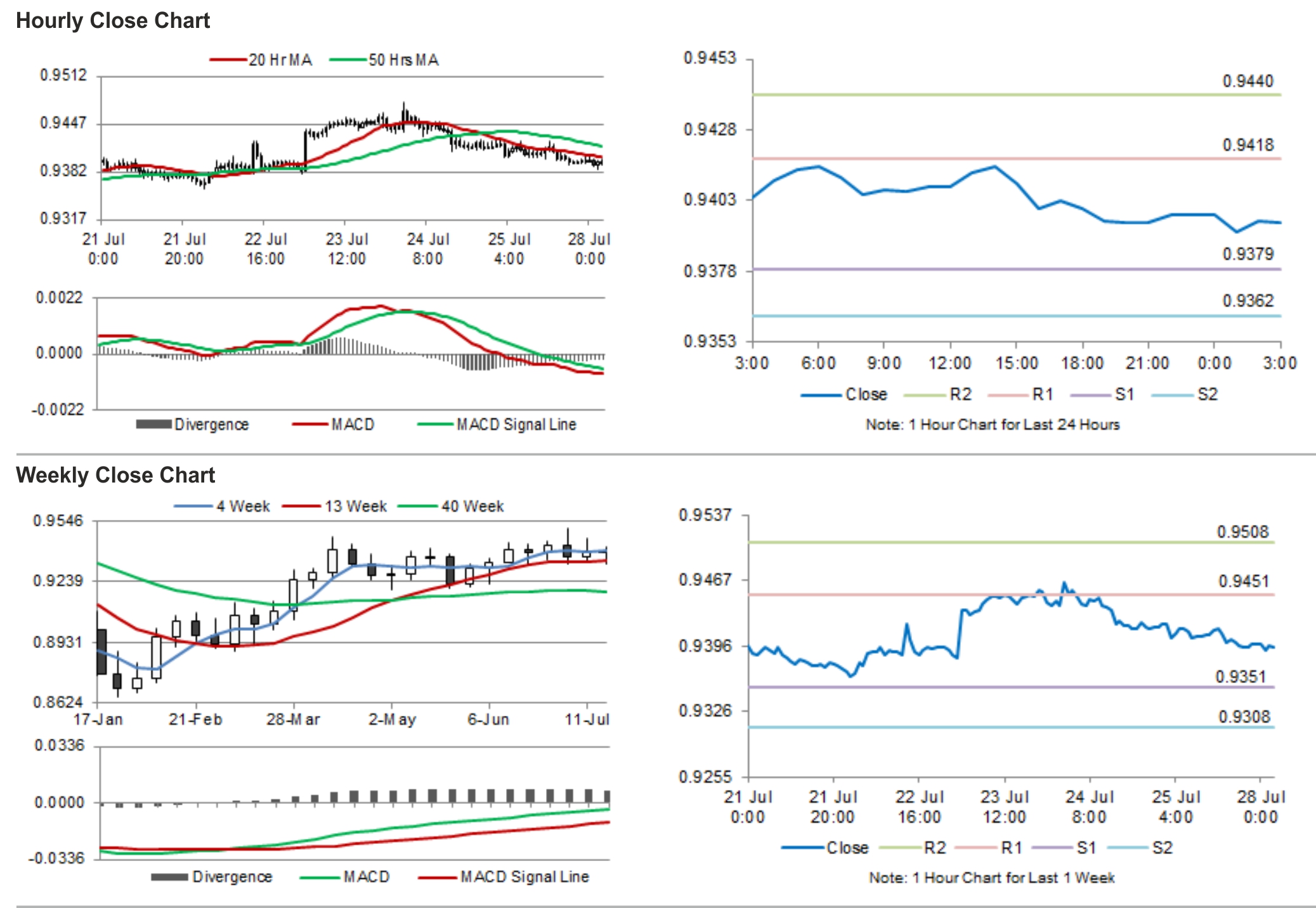

The pair is expected to find support at 0.9379, and a fall through could take it to the next support level of 0.9362. The pair is expected to find its first resistance at 0.9418, and a rise through could take it to the next resistance level of 0.9440.

With no economic release scheduled today, investors would pay attention to the new home sales data, to be released early tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.