For the 24 hours to 23:00 GMT, AUD strengthened 0.44% against the USD to close at 1.0539.

Minneapolis Federal Reserve, President Narayana Kocherlakota stated that the recent rise in oil prices was no prelude to broader price increases that would force the US Federal Reserve to raise interest rates.

In the Asian session at 3:00GMT, the pair is trading at 1.0524, 0.14% lower from the New York session close, on speculation China’s central bank may raise interest rates further to combat inflation, damping demand for the South Pacific nation’s assets.

LME Copper prices declined 3.1% or $299.0/MT to $9,326.3/ MT. Aluminium prices declined 0.6% or $17.0/MT to $2,617.3/ MT.

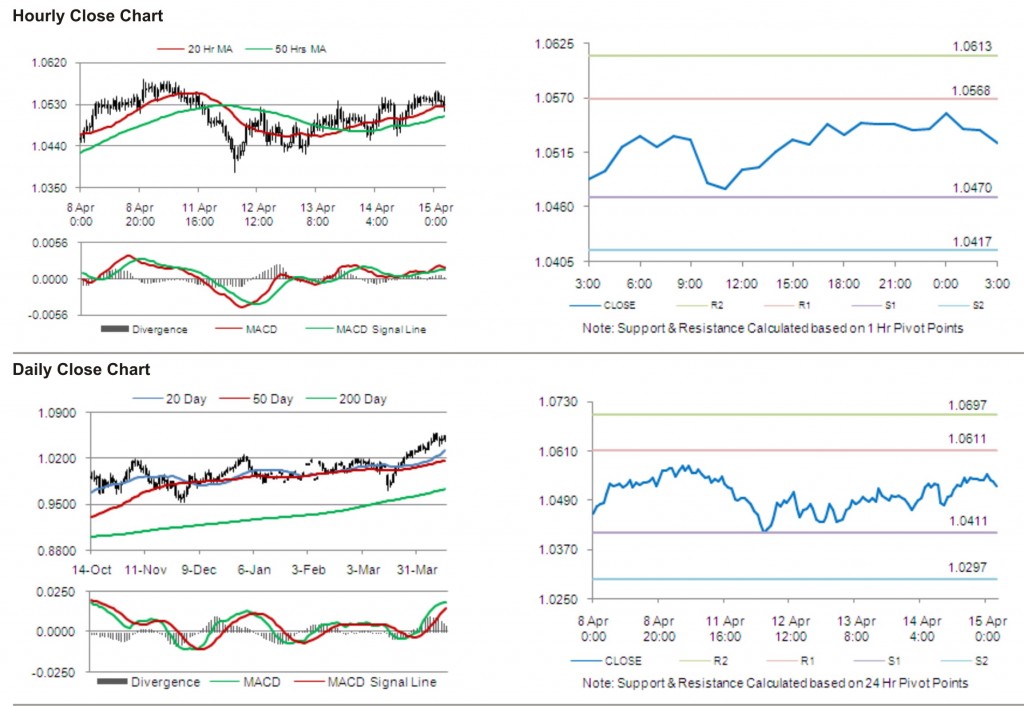

The pair is expected to find first short term resistance at 1.0568, with the next resistance levels at 1.0613 and 1.0711, subsequently. The first support for the pair is seen at 1.0470, followed by next supports at 1.0417 and 1.0319 respectively.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.