For the 24 hours to 23:00 GMT, AUD weakened 0.32% against the USD to close at 1.0738, as greenback strengthened after comments from the Federal Reserve Chairman Bernanke reduced speculation that the central bank would provide more monetary stimulus.

In the Asian session, at GMT0400, the pair is trading at 1.0751, with the AUD trading 0.11% higher from yesterday’s close, after release of positive economic data from Australia and China.

This morning, Australian Industry Group reported that manufacturing sector expanded for a third consecutive month to 51.3 in February.

Additionally, Australian Bureau of Statistics reported building permits rose 0.9% (MoM) in January.

Meanwhile in China, official manufacturing Purchasing Managers’ Index (PMI) rose more-than-expected to a reading of 51.0 in February, following a reading of 50.5 recorded in the January. Moreover, the HSBC manufacturing PMI climbed to a reading of 49.6 in February.

LME Copper prices declined 0.8% or $72.5/MT to $8584.0/ MT. Aluminium prices declined 0.3% or $6.5/MT to $2301.3/ MT.

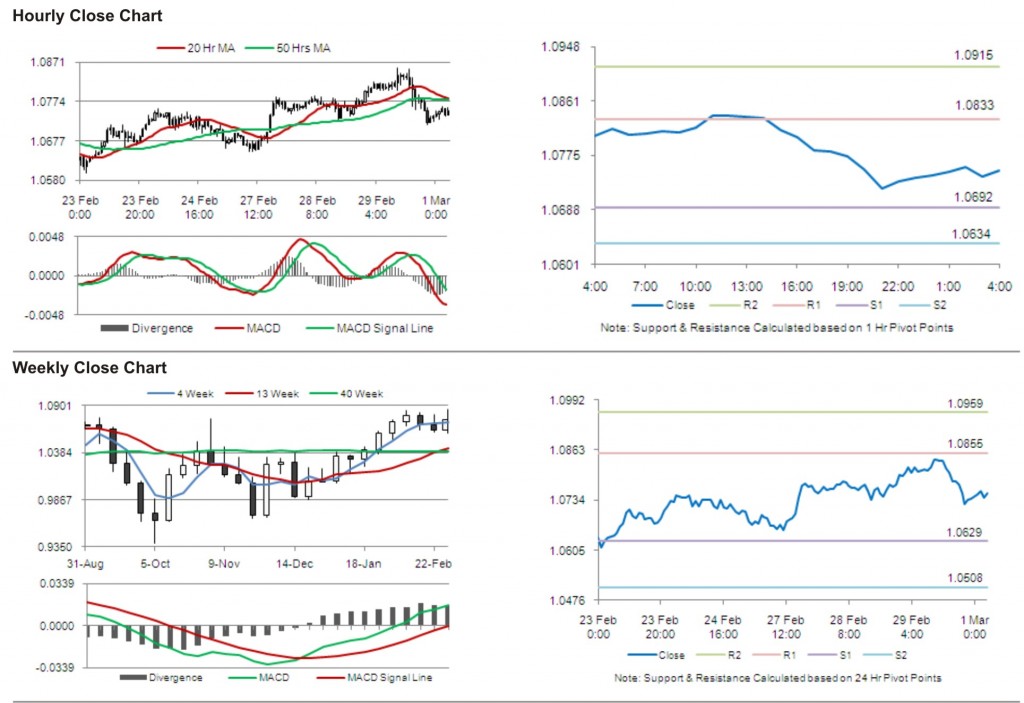

The pair is expected to find support at 1.0692, and a fall through could take it to the next support level of 1.0634. The pair is expected to find its first resistance at 1.0833, and a rise through could take it to the next resistance level of 1.0915.

Trading trends in the pair today are expected to be determined by the release of Australian Commodity Index.

The currency pair is trading below 20 Hr and its 50 Hr moving averages.