For the 24 hours to 23:00 GMT, the AUD weakened 0.31% against the USD to close at 0.9368.

LME Copper prices declined 0.5% or $37.0/MT to $ 6989.5/MT. Aluminium prices rose 1.5% or $ 29.5/MT to $ 1988.0/MT.

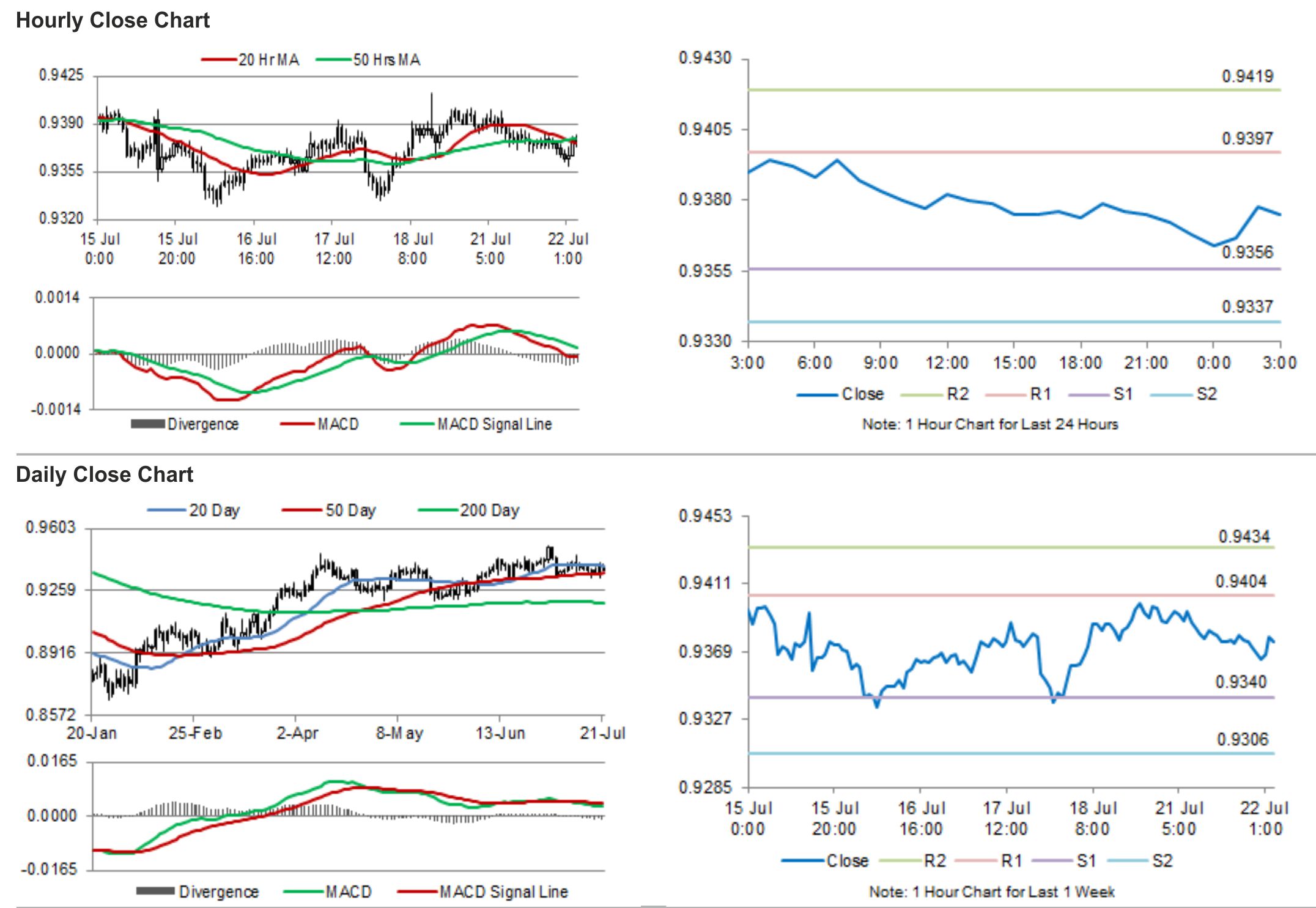

In the Asian session, at GMT0300, the pair is trading at 0.9375, with the AUD trading 0.07% higher from yesterday’s close.

Earlier this morning, the RBA Governor Glenn Stevens did not comment anything on the strength of the Australian Dollar. However, he noted that in order to witness strong recovery in Australia, businesses need to take more risk. He further added that the nation’s highly accommodative financial conditions would have a considerable effect in fostering real growth.

Economic data released from China, Australia’s largest trading partner, indicated that the leading economic index in China climbed 1.3% in June, following an increase of 0.7% recorded in the preceding month.

The pair is expected to find support at 0.9356, and a fall through could take it to the next support level of 0.9337. The pair is expected to find its first resistance at 0.9397, and a rise through could take it to the next resistance level of 0.9419.

Going forward, investors would turn all their attention to the consumer price index data from Australia to be released early tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.