For the 24 hours to 23:00 GMT, the AUD weakened 0.25% against the USD to close at 0.7758.

Yesterday, a global investment bank downgraded Australia’s economic growth prospects and projected that the RBA would again cut its benchmark interest rate in May.

Losses in the Aussie were capped after the People’s Bank of China decided to slash banks’ reserve requirement ratio (RRR) by 50 basis points to 19.5%, its first such cut since May 2012, in order to fight an economic slowdown and looming deflation in the nation.

LME Copper prices rose 0.23% or $13.0/MT to $5708.0/MT. Aluminium prices declined 0.40% or $7.5/MT to $1862.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7783, with the AUD trading 0.33% higher from yesterday’s close.

Earlier today, data showed that the seasonally adjusted retail sales in Australia rose 0.2% on a MoM basis in December, lower than market expected gain of 0.3% and compared to an advance of 0.1% registered in prior month. Meanwhile, the nation’s HIA new home sales retreated 1.9% on a monthly basis in December, following a 2.2% rise recorded in November.

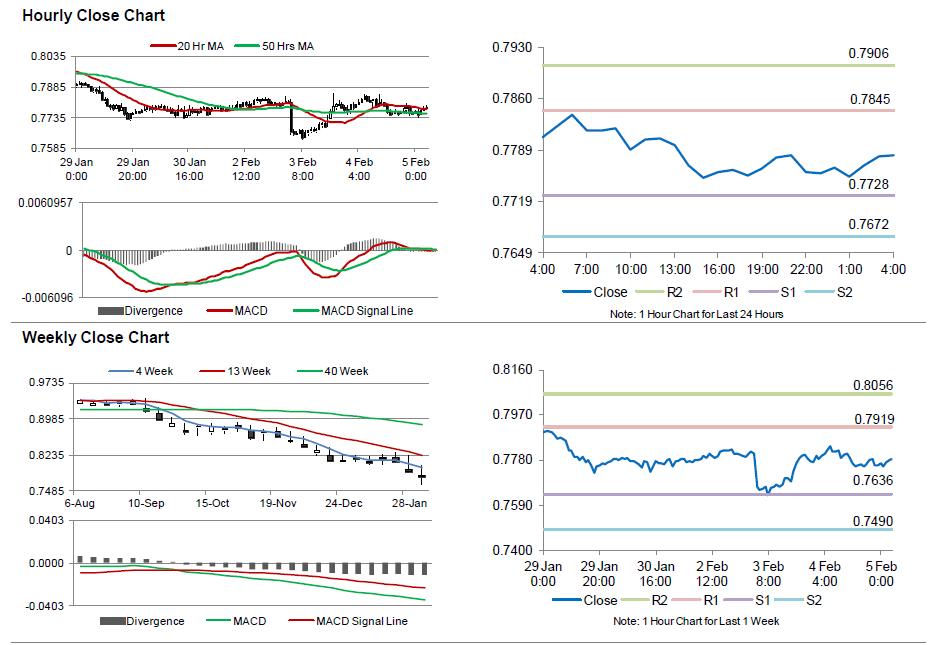

The pair is expected to find support at 0.7728, and a fall through could take it to the next support level of 0.7672. The pair is expected to find its first resistance at 0.7845, and a rise through could take it to the next resistance level of 0.7906.

Meanwhile, investors await Australia’s AiG performance of construction index data, scheduled in the late hours today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.