On Friday, the AUD weakened marginally against the USD to close at 0.9025, amid concerns over the economic growth-outlook of its largest trading partner, China.

LME Copper prices declined 0.1% or $5.0/MT to $6490.0/MT. Aluminium prices fell 0.3% or $5.0/MT to $1698.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.9051, with the AUD trading 0.29% higher from Friday’s close. Earlier today, the Australian Bureau of Statistics reported that new motor vehicle sales in Australia rose 0.1% (MoM) in February, following a 4.0% drop in the previous month.

The People’s Bank of China announced its decision to relax its grip on the Chinese Yuan by permitting to trade as much as 2% on either side of the government’s reference rate from 1% previously, in order to introduce greater two-way volatility into its trading and prevent short-term speculators who were betting on the Yuan’s continued rise.

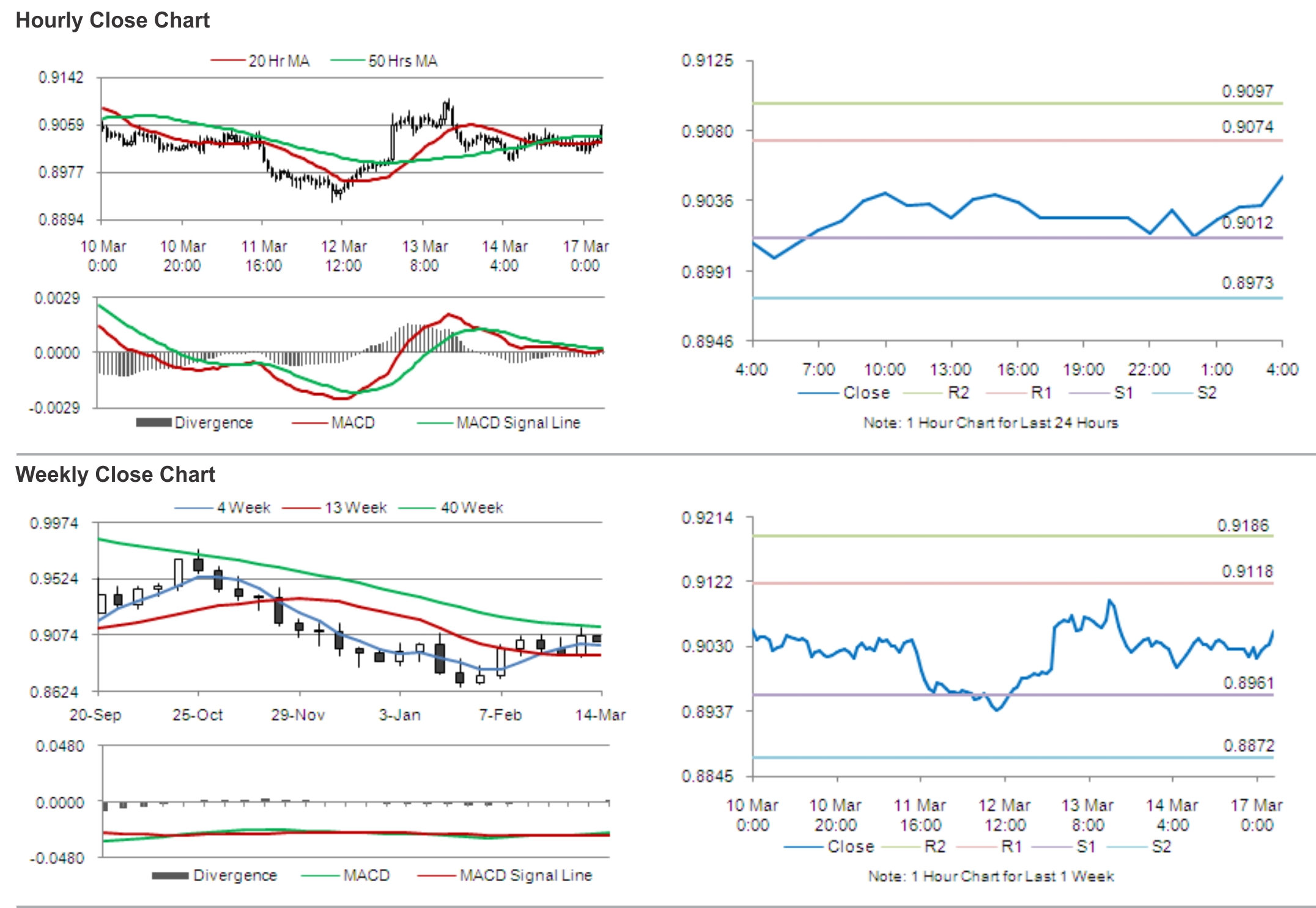

The pair is expected to find support at 0.9012, and a fall through could take it to the next support level of 0.8973. The pair is expected to find its first resistance at 0.9074, and a rise through could take it to the next resistance level of 0.9097.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.