For the 24 hours to 23:00 GMT, the AUD weakened 0.82% against the USD to close at 0.8762.

Yesterday, the RBA’s Financial Stability Head, Luci Ellis stated that the low interest rates in Australia were boosting house prices but not encouraging the construction of new houses. Further she highlighted that the central bank remains concerned over the increasing house prices and rapidly growing investor activity that could pose a risk to banking stability and to the nation’s economy.

LME Copper prices rose 0.18% or $12.0/MT to $6767.0/MT. Aluminium prices rose 0.18% or $3.5/MT to $1924.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.8764, with the AUD trading marginally higher from yesterday’s close. In a note-worthy event, China is all set to re-introduce a levy on coal import tariffs after almost a decade. The new measure which would be implemented starting from 15th October would have a great impact on Australian miners who are the largest suppliers of coal to the country.

Earlier today, data indicated that home loans in Australia unexpectedly eased 0.9% on a monthly basis in August, lower than market expectations for an increase of 0.2% and following a revised rise of 0.3% in July. Meanwhile, the nation’s investment lending fell 0.1% in August, after registering a rise of 5.6% in the prior month.

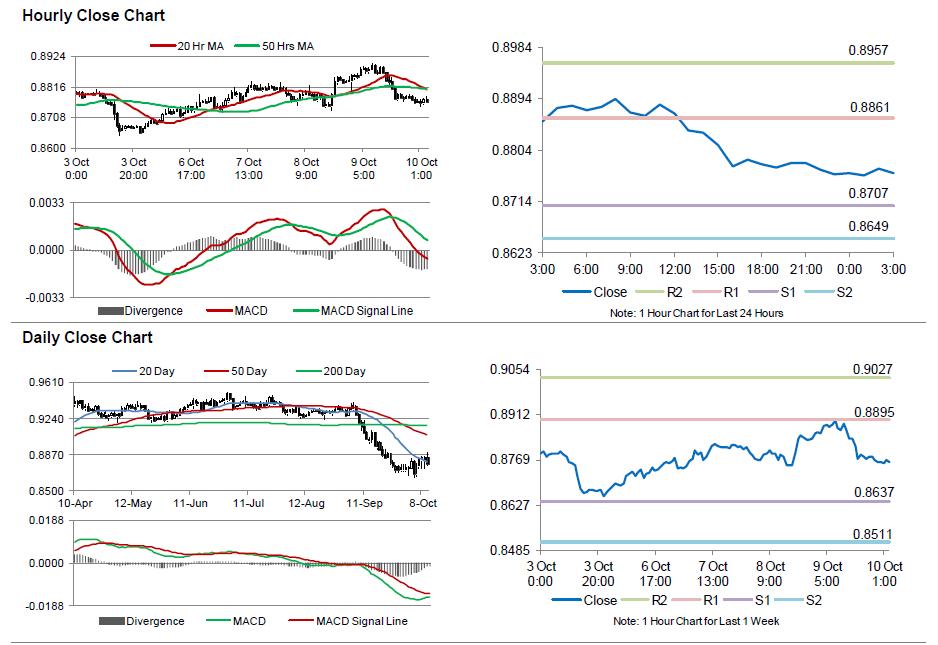

The pair is expected to find support at 0.8707, and a fall through could take it to the next support level of 0.8649. The pair is expected to find its first resistance at 0.8861, and a rise through could take it to the next resistance level of 0.8957.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.