For the 24 hours to 23:00 GMT, AUD strengthened 1.14% against the USD to close at 1.0740, after a bi-partisan plan to avoid a US debt default emerged in the US overnight.

According to media reports, a bipartisan group of US senators has offered a plan that could revive stalled debt talks. The deal proposes $US3.75 trillion ($A3.55 trillion) in savings over 10 years and contains $US1.2 trillion ($A1.14 trillion) in new revenue.

In the morning economic news, the Westpac Leading Index declined by 0.1% (M-o-M) in May, from a month earlier to 279.5.

In the Asian session at 3:00GMT, the pair is trading at 1.0726, 0.13% lower from yesterday’s close at 23:00 GMT.

LME Copper prices rose 0.7% or $65.3/MT to $9,754.8/ MT. Aluminium prices rose 1.5% or $37.5/MT to $2,481.8/ MT.

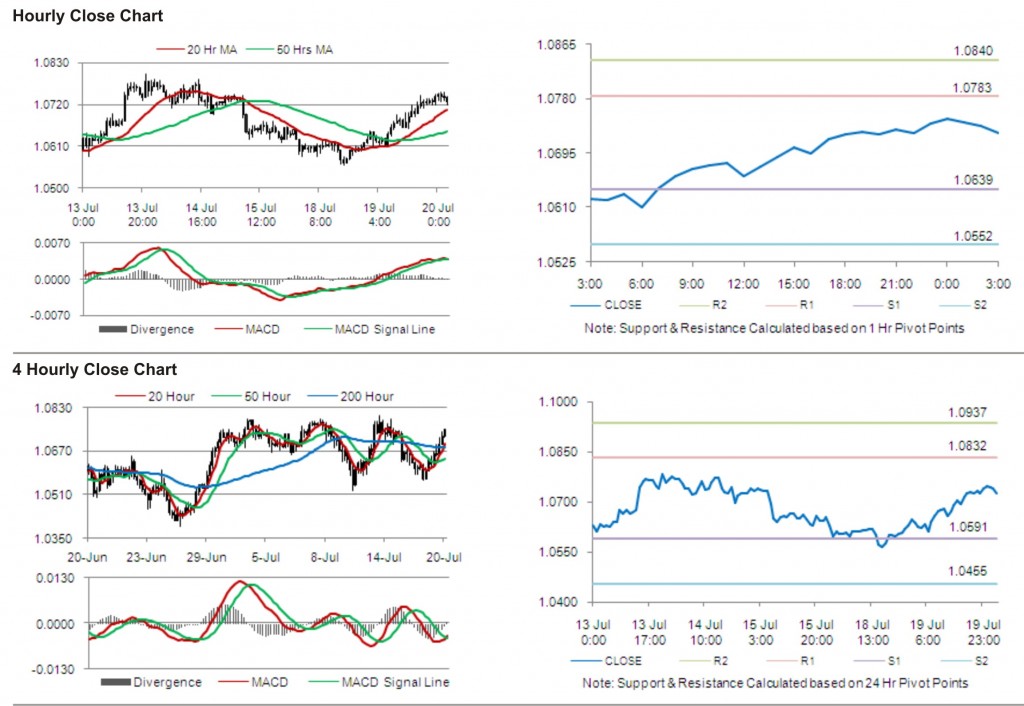

The pair is expected to find first short term resistance at 1.0783, with the next resistance levels at 1.0840 and 1.0984, subsequently. The first support for the pair is seen at 1.0639, followed by next supports at 1.0552 and 1.0408 respectively.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.