For the 24 hours to 23:00 GMT, the AUD declined 0.73% against the USD and closed at 0.7793.

LME Copper prices declined 1.2% or $83.0/MT to $7028.0/MT. Aluminium prices declined 0.7% or $16.0/MT to $2172.5/MT.

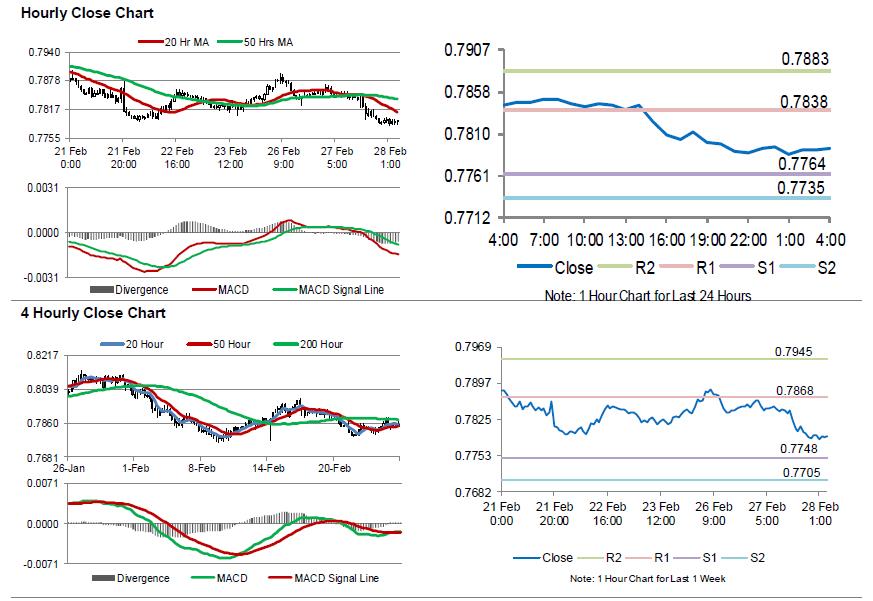

In the Asian session, at GMT0400, the pair is trading at 0.7792, with the AUD trading marginally lower against the USD from yesterday’s close.

Data released overnight indicated that Australia’s private sector credit climbed less-than-anticipated 0.3% on a monthly basis in January, compared to market expectations for a gain of 0.4%. The private sector credit had registered a similar rise in the previous month.

Elsewhere in China, Australia’s largest trading partner, the NBS manufacturing PMI declined to a 19-month low level of 50.3 in February, more than market expectations of a fall to a level of 51.1. In the previous month, the NBS manufacturing PMI had recorded a reading of 51.3. Moreover, the nation’s NBS non-manufacturing PMI fell more-than-expected to a level of 54.4 in February, hitting its lowest level since October 2017. The PMI had registered a reading of 55.3 in the prior month, while markets were anticipating it to ease to a level of 55.0.

The pair is expected to find support at 0.7764, and a fall through could take it to the next support level of 0.7735. The pair is expected to find its first resistance at 0.7838, and a rise through could take it to the next resistance level of 0.7883.

Moving ahead, Australia’s AiG performance of manufacturing index for February, slated to release overnight, will garner a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.