On Friday, the AUD weakened 0.32% against the USD to close at 0.8931.

On Saturday, a report from China, Australia’s largest trading partner, showed that the NBS manufacturing PMI edged down to a reading of 50.2 in February, less than market estimates, from a level of 50.5 recorded in the preceding month.

LME Copper prices rose marginally by $2.5/MT to $7097.5/MT. Aluminium prices advanced 0.5% or $8.0/MT to $1724.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8911, with the AUD trading 0.22% lower from Friday’s close, as tensions over Ukraine led to the increase in demand for safe haven assets.

On the economic front, the AiG performance of manufacturing index in Australia improved to a reading of 48.6 in February, from a figure of 46.7 recorded in the preceding month. Similarly, Australia’s HIA new home sales rose 0.5% (MoM) in January, from a 0.4% drop recorded in the previous month. Separately, data from China showed that the non-manufacturing PMI in the nation rose to a level of 55.0 in February, from previous month’s reading of 53.4 while the HSBC manufacturing PMI fell in-line with analysts’ expectations to a figure of 48.5, from an earlier month’s reading of 49.5.

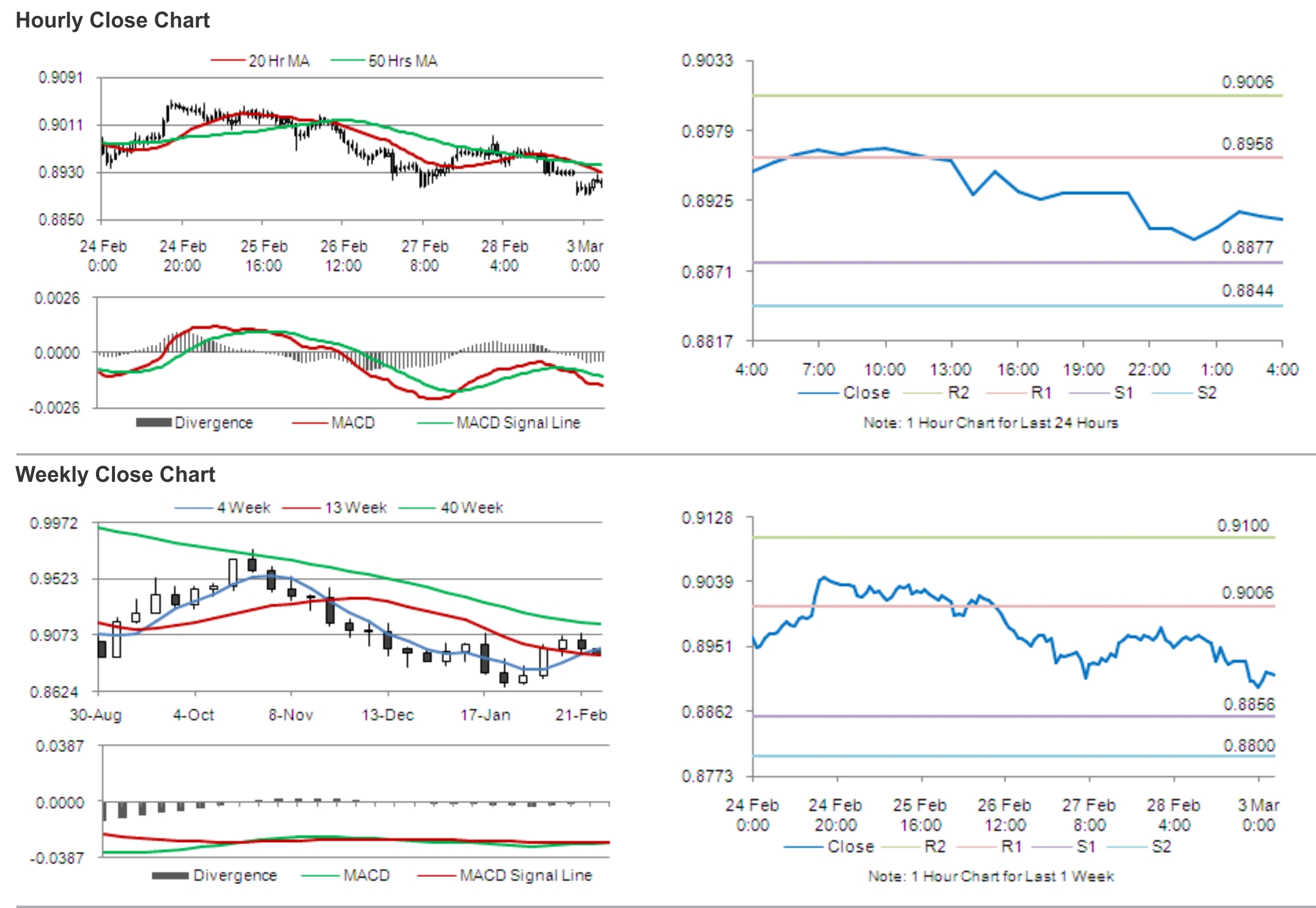

The pair is expected to find support at 0.8877, and a fall through could take it to the next support level of 0.8844. The pair is expected to find its first resistance at 0.8958, and a rise through could take it to the next resistance level of 0.9006.

Investors would turn their attention to the RBA interest rate decision scheduled tomorrow, wherein the central bank is expected to keep its rates unchanged.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.