For the 24 hours to 23:00 GMT, the AUD strengthened 0.50% against the USD to close at 0.9162.

LME Copper prices declined 0.57% or $39.5 to $6897.5. Aluminium prices declined 1.61% or $33.0MT to $2012.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9189, with the AUD trading 0.29% higher from yesterday’s close.

Early morning data indicated that, unemployment rate in Australia fell more than expected in August to 6.1%, from 6.4% in the preceding month. Analysts had expected a fall to 6.3%. Additionally, the number of people employed in the nation rose 121.0K in August, following a revised decline of 0.3K jobs in July, while full time employment registered a gain of 14.3K jobs, from an increase of 14.5K jobs recorded in the same period.

Elsewhere, in China, Australia’s biggest trading partner, the consumer price index rose 0.2%, on a monthly basis, in August, lower than market expectations for a rise of 0.4%. It had risen 0.1% in the previous month. Additionally, the producer price index fell 1.2%, on a YoY basis, in August, more than market expectations for a fall of 1.1%.

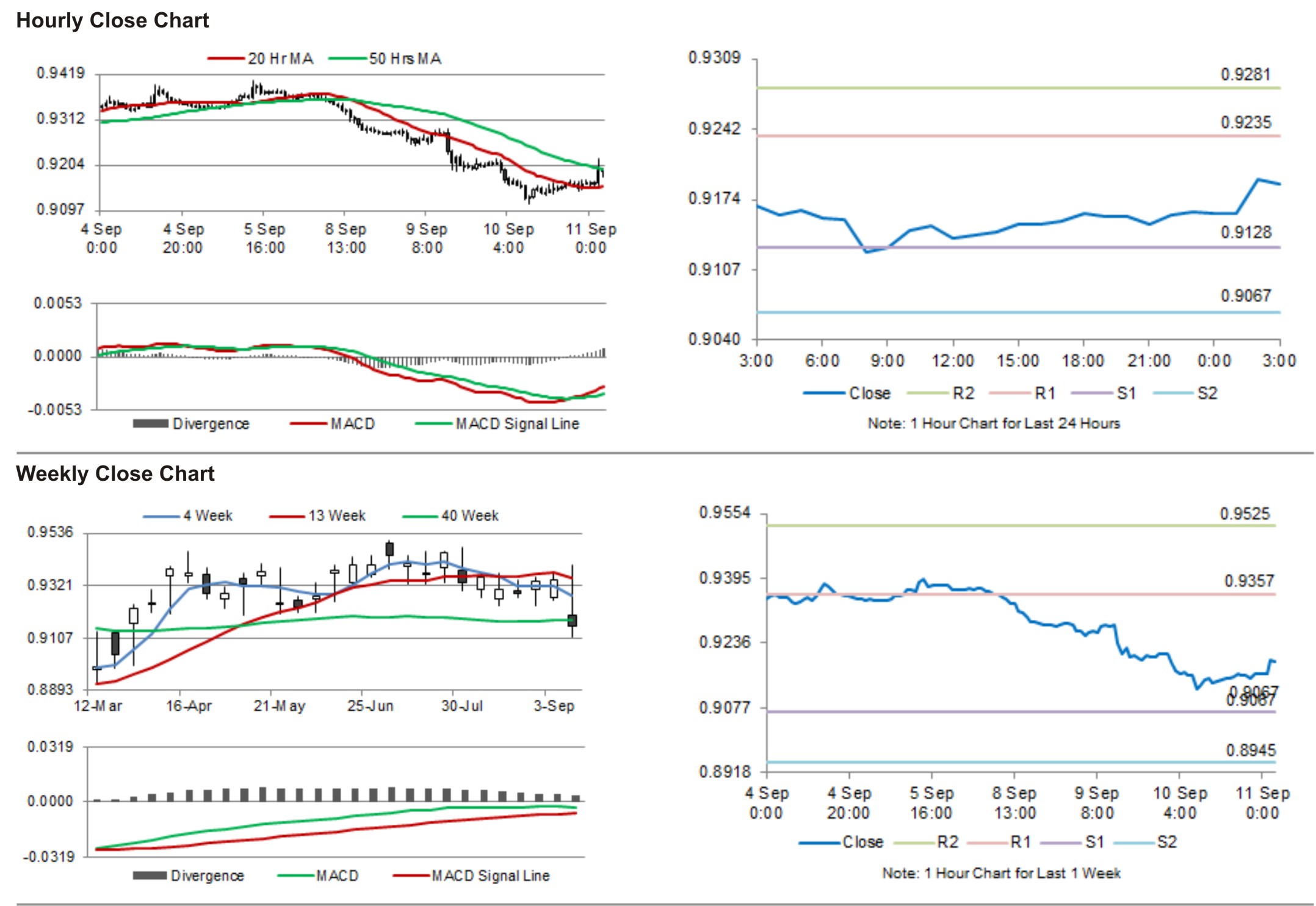

The pair is expected to find support at 0.9128, and a fall through could take it to the next support level of 0.9067. The pair is expected to find its first resistance at 0.9235, and a rise through could take it to the next resistance level of 0.9281.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.