For the 24 hours to 23:00 GMT, the AUD weakened 1.94% against the USD to close at 0.7215.

LME Copper prices declined 1.40% or $74.5/MT to $5260.5/MT. Aluminium prices rose/declined 2.95%or $47.5/MT to $1560.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7232, with the AUD trading 0.23% higher from yesterday’s close.

Overnight data revealed that Australia’s Westpac consumer confidence climbed 4.2% in October, from a 5.6% decline in the previous month.

Early morning data showed that consumer price inflation in China, Australia’s largest trading partner, rose 1.6% YoY in September, following a 2.0% rise in August. However, the country’s producer price inflation declined 5.9% in the same month, in line with expectations and clocking its 43th straight month of decline. It had witnessed a similar decline in August.

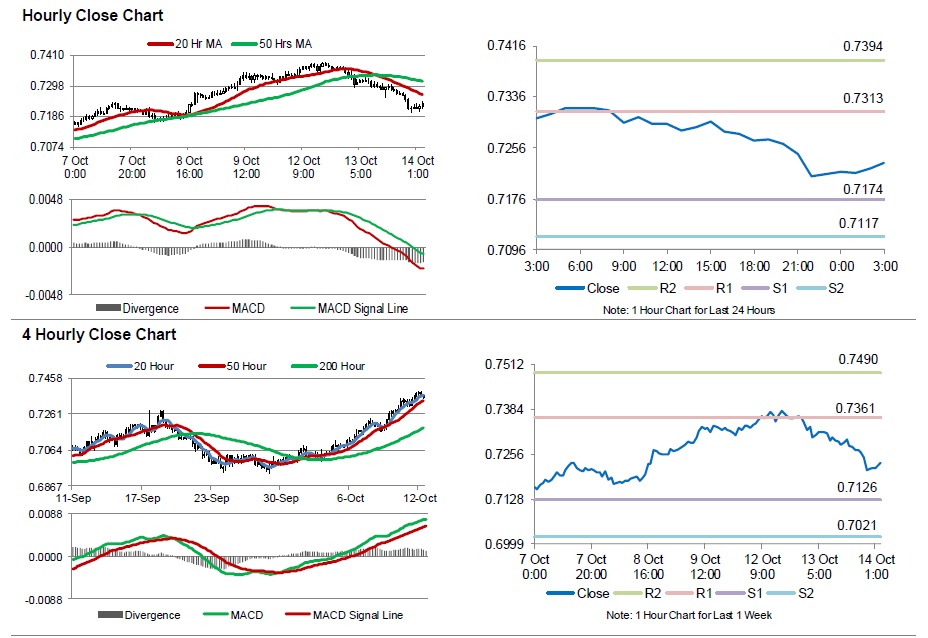

The pair is expected to find support at 0.7174, and a fall through could take it to the next support level of 0.7117. The pair is expected to find its first resistance at 0.7313, and a rise through could take it to the next resistance level of 0.7394.

Going ahead, Australia’s unemployment rate data for September, scheduled to be released tomorrow, is expected to grab a lot of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.