For the 24 hours to 23:00 GMT, the AUD declined 0.45% against the USD and closed at 0.7447.

LME Copper prices declined 1.1% or $65.5/MT to $5838.0/MT. Aluminium prices rose 0.2% or $3.5/MT to $1731.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7455, with the AUD trading 0.11% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s home loan approvals fell less-than-anticipated by 0.8% in October, compared to a revised advance of 1.5% in the prior month.

Earlier in the session, in China, Australia’s largest trading partner, the consumer price index (CPI) rose more-than-expected by 2.3% YoY in November, advancing for the third straight month, thus suggesting that inflation in the world’s second largest economy is picking-up pace gradually. Markets expected the CPI to gain 2.2%, following a rise of 2.1% in the previous month. Moreover, the nation’s producer price index increased at its fastest pace in five years, after it rose 3.3% on an annual basis in November, surpassing market consensus for a gain of 2.3% and compared to a rise of 1.2% in the prior month.

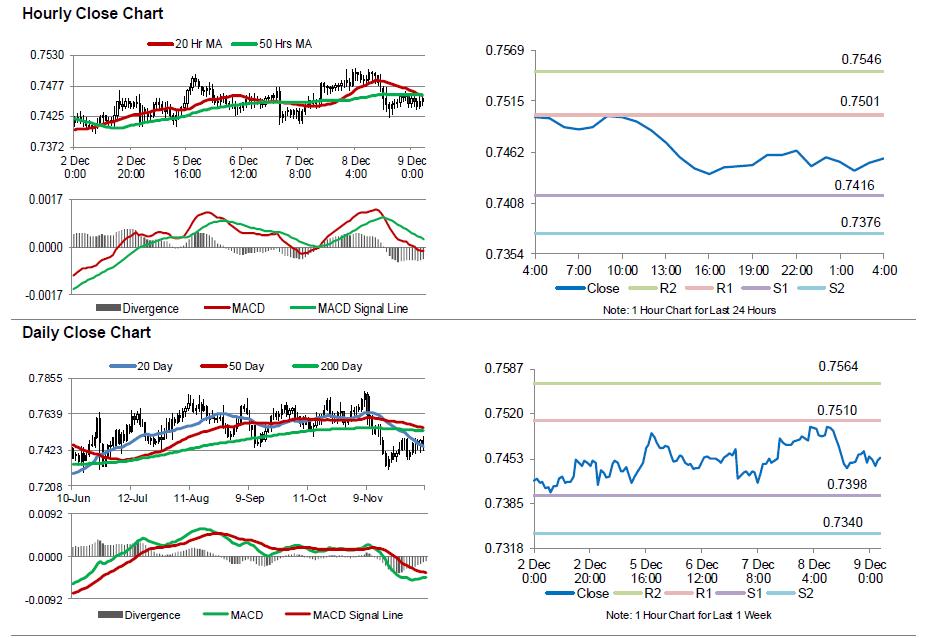

The pair is expected to find support at 0.7416, and a fall through could take it to the next support level of 0.7376. The pair is expected to find its first resistance at 0.7501, and a rise through could take it to the next resistance level of 0.7546.

Looking ahead, Australia’s unemployment rate, NAB business confidence, consumer inflation expectations and Westpac consumer confidence data, all scheduled to release next week, would garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.