For the 24 hours to 23:00 GMT, AUD weakened a marginal 0.05% against the USD to close at 1.0558.

Yesterday, the Reserve Bank of Australia (RBA) decided to retain its benchmark cash rate at 4.75%.

Meanwhile, this morning, the Australian Bureau of Statistics reported that Gross Domestic Product (GDP) climbed 1.2% in the second quarter of 2011. Additionally, Australian Industry Group’s (AIG) construction index declined to 32.1 in August, the 15th consecutive contraction and the lowest level since March 2009.

In the Asian session at 3:00GMT, the Australian Dollar is trading at 1.0579, 0.20% higher from yesterday’s close at 23:00 GMT.

LME Copper prices declined 0.2% or $15.5/MT to $8919.3/ MT. Aluminium prices declined 0.7% or $17.5/MT to $2345.8/ MT.

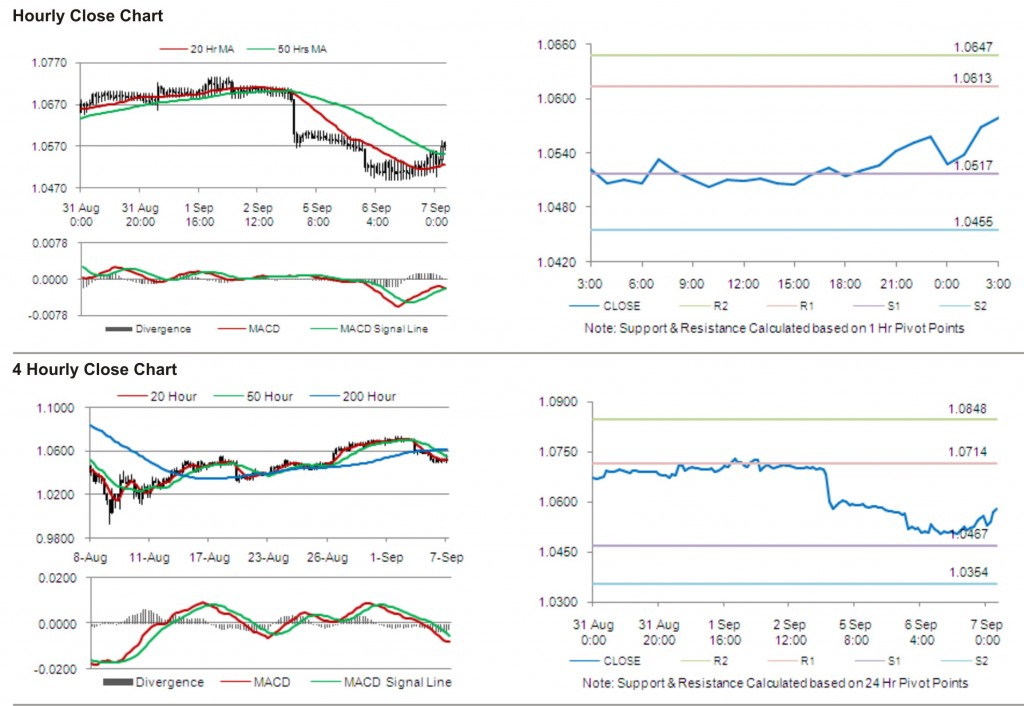

The pair is expected to find first short term resistance at 1.0613, with the next resistance levels at 1.0647 and 1.0743, subsequently. The first support for the pair is seen at 1.0517, followed by next supports at 1.0455 and 1.0359 respectively.

Trading trends in the pair today are expected to be determined by release of employment data in Australia.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.