For the 24 hours to 23:00 GMT, the AUD weakened 1.04% against the USD to close at 0.7034.

LME Copper prices rose 1.58% or $71.5/MT to $4605.5/MT. Aluminium prices rose 0.30% or $4.5/MT to $1524.5/MT.

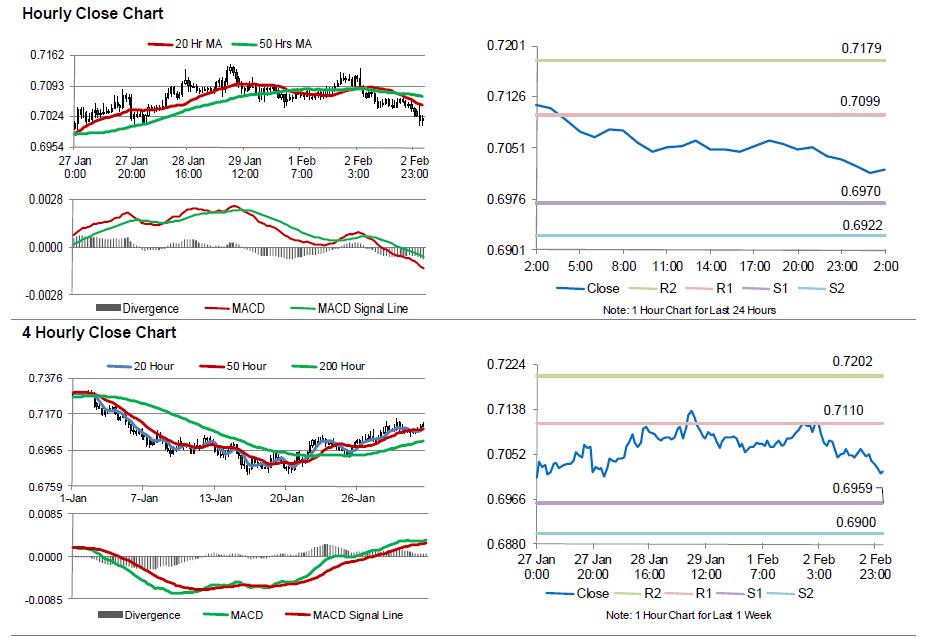

In the Asian session, at GMT0400, the pair is trading at 0.7024, with the AUD trading 0.14% lower from yesterday’s close.

Overnight data showed that, Australia’s trade deficit unexpectedly expanded to a 6-month high level of AUD3535.0 million in December, following a revised deficit of AUD2727.0 million in the previous month and compared to market consensus for it to narrow down to AUD2450.0 million. Separately the nation’s building approvals advanced more than expected by 9.2% MoM in December, compared to a revised drop of 12.4% in the preceding month and beating market expectations of a rise of 4.5%. Additionally, the nation’s AiG performance of service index advanced to a level of 48.4 in January, from a reading of 46.3 in the previous month.

Elsewhere, in China, Australia’s largest trading partner, Caixin services PMI rose to a level of 52.4 in January, compared to a reading of 50.2 in the preceding month.

The pair is expected to find support at 0.6974, and a fall through could take it to the next support level of 0.6924. The pair is expected to find its first resistance at 0.7102, and a rise through could take it to the next resistance level of 0.7181.

Going forward, Australia’s NAB business confidence data, slated to be released overnight, will grab a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.