For the 24 hours to 23:00 GMT, the AUD weakened 1.03% against the USD to close at 0.7261.

LME Copper prices declined 0.96% or $44.5/MT to $4592.5/MT. Aluminium prices declined 0.33% or $5.0/MT to $1498.0/MT.

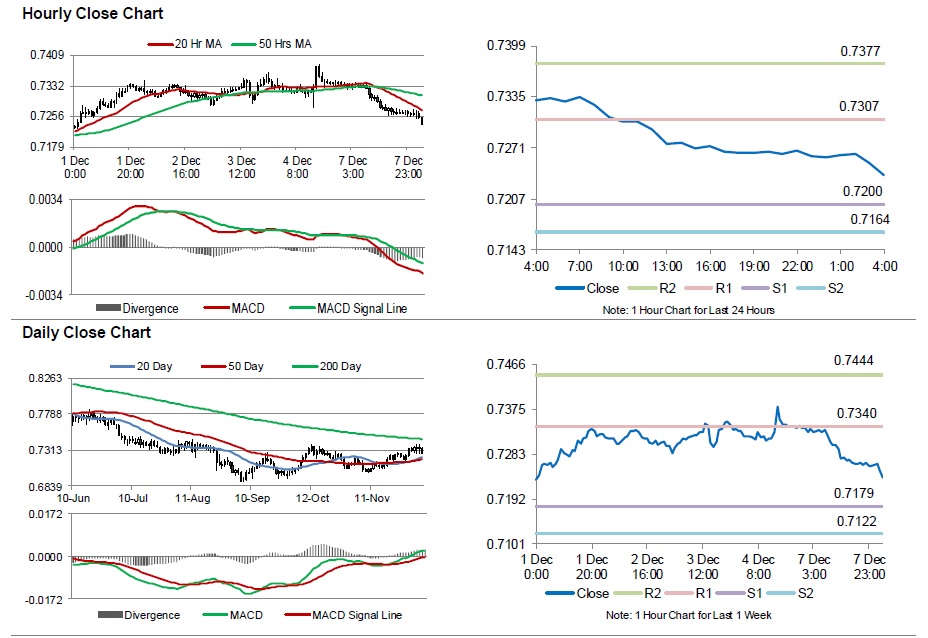

In the Asian session, at GMT0400, the pair is trading at 0.7236, with the AUD trading 0.34% lower from yesterday’s close.

Early morning data showed that Australia’s NAB business confidence index rose to a level of 5.0 in November, compared to a revised reading of 3.0 in the previous month.

Elsewhere, in China, Australia’s largest trading partner, trade surplus dropped to CNY343.1 billion in November, following a surplus of CNY393.2 billion in the previous month. Market anticipation was for trade surplus to expand to CNY407.5 billion. Also, the nation’s imports slid 5.6% YoY in November, against investor expectation for it to fall 11.3%, and compared to a drop of 16.0% in the previous month. Additionally, exports fell 3.7% YoY in November during the same period, compared to a fall of 3.6% in October. Markets were expecting exports to fall 2.9%.

The pair is expected to find support at 0.7200, and a fall through could take it to the next support level of 0.7164. The pair is expected to find its first resistance at 0.7307, and a rise through could take it to the next resistance level of 0.7377.

Going ahead, investors will look forward to Australia’s Westpac consumer confidence index data for December, scheduled to be released overnight. Additionally, China’s consumer price inflation data for November, due tomorrow morning, will also grab a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.