For the 24 hours to 23:00 GMT, AUD weakened 0.60% against the USD to close at 1.0669.

In the Asian session, at GMT0400, the pair is trading at 1.0617, with the AUD trading 0.49% lower from yesterday’s close, following the Reserve Bank of Australia’s (RBA) decision to leave rates on hold at 4.25% and after larger- than-expected rise in the current account deficit.

This morning, Australian Bureau of Statistics reported Current Account deficit rose larger-than-expected to 8.37 billion (QoQ) in December from a 5.63 billion in September. Meanwhile, Reserve bank of Australia (RBA), in its monetary policy decision, kept its key cash rate constant at 4.25%. Additionally, the central bank stated that if demand conditions weaken materially, the inflation outlook would provide scope for easier monetary policy.

LME Copper prices declined 0.9% or $73.0/MT to $ 8501.8/ MT. Aluminium prices declined 1.8% or $42.0/MT to $ 2253.3/ MT.

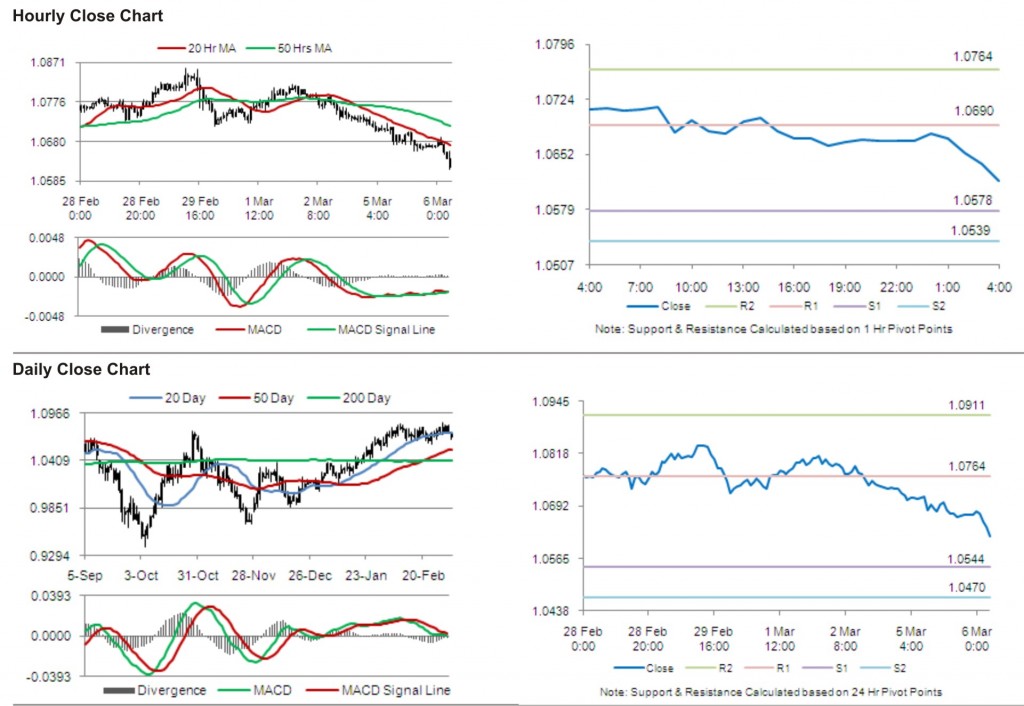

The pair is expected to find support at 1.0578, and a fall through could take it to the next support level of 1.0539. The pair is expected to find its first resistance at 1.0690, and a rise through could take it to the next resistance level of 1.0764.

The pair is expected to trade on the cues by the release of Australian AiG Performance of Construction Index, later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.