For the 24 hours to 23:00 GMT, the AUD strengthened 0.40% against the USD to close at 0.9305.

In economic news, Retail sales in China, Australia’s biggest trading partner, advanced 12.2% in July, on an annual basis, lesser than market expectations for a rise of 12.5%. Retail sales had risen 12.4% in the prior month. Meanwhile, the industrial output rose 9.0% in July, on an annual basis, in line with the market forecast.

LME Copper prices declined 1.4% or $ 100.0/MT to $ 6925.5/MT. Aluminium prices declined 0.7% or $ 14.0/MT to $ 2026.0/MT.

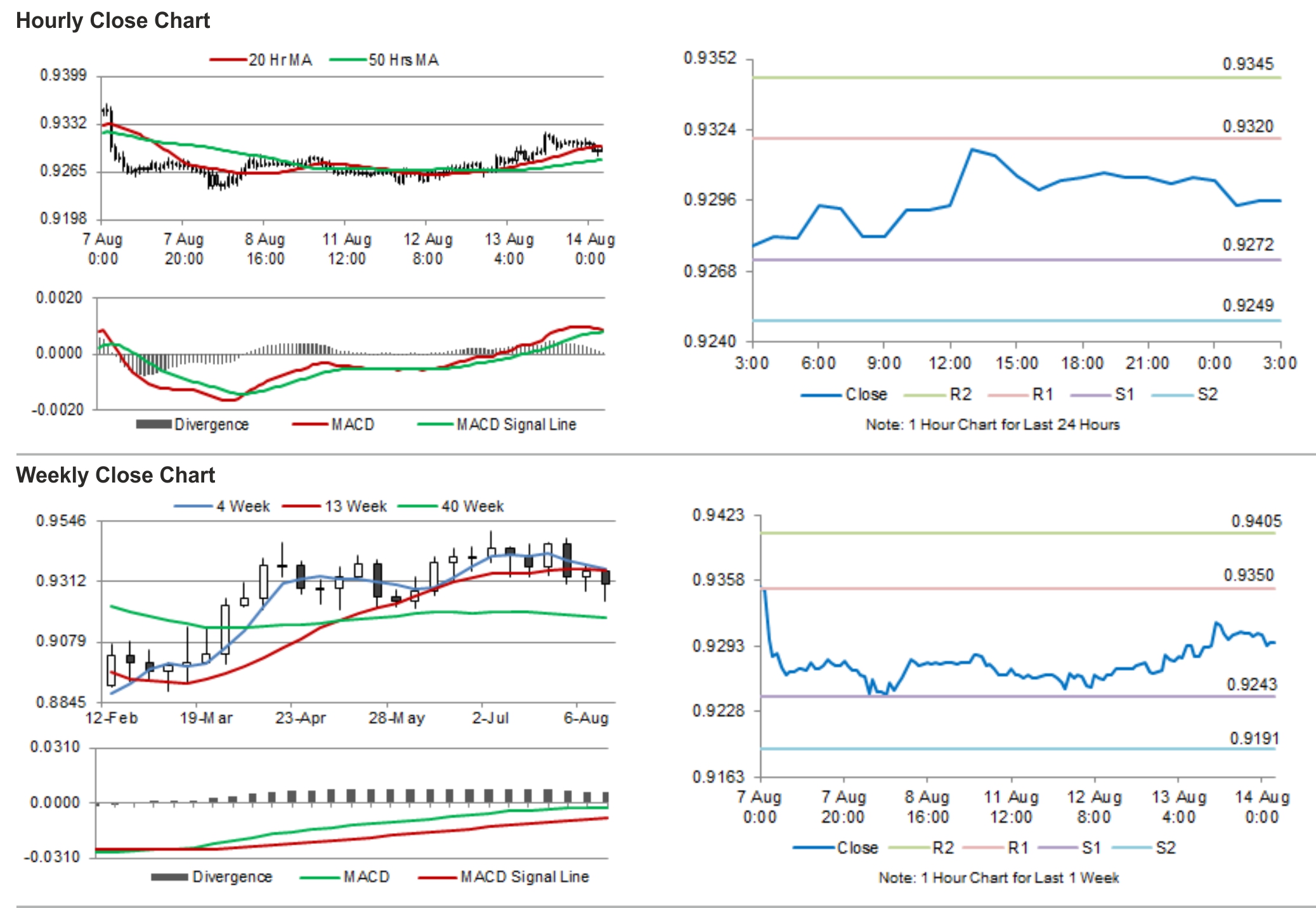

In the Asian session, at GMT0300, the pair is trading at 0.9296, with the AUD trading 0.1% lower from yesterday’s close.

Earlier in the morning, the consumer inflation expectations in Australia fell to a level of 3.1% in July. In the previous month, it had recorded a reading of 3.8%.

The pair is expected to find support at 0.9272, and a fall through could take it to the next support level of 0.9249. The pair is expected to find its first resistance at 0.932, and a rise through could take it to the next resistance level of 0.9345.

Amid lack of economic releases from Australia today, trading trends in the AUD would be determined by global events/news.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.